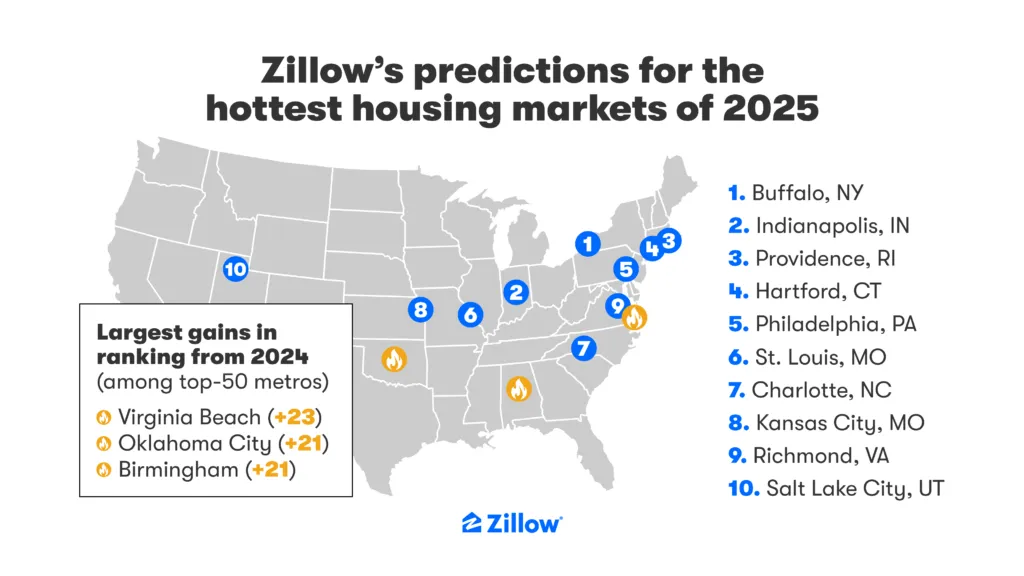

Top 10 Real Estate Markets by 2025: Zillow Predictions

If you're trying to determine where the real estate stock will be in 2025, look no further! According to Zillow analysis, the The hottest real estate markets for 2025 will be largely concentrated in the Northeast and Midwest, with Buffalo, New York topping the list again. These markets stand out for their combination of relative affordability, job growth, and a rapid pace of sales. In some cases, homes sell within a week, far exceeding the national average. Let's take a look at why these particular areas are poised to continue getting stronger. Top 10 Real Estate Markets by 2025: Zillow Predictions Why these markets are heating up When Zillow When crunching the numbers for their 2025 listing, they looked at more than just prices. The analysis focused on several key factors: Home value growth: This measures how much home values are expected to increase. It is not always about taking the biggest leap, but about sustainable and constant growth. Projected change in owner-occupied households: This gives an idea of future demand. More homes means more people looking for homes. Job growth versus new construction: A vibrant job market attracts new residents, but if not enough new homes are built, competition will increase, which can put upward pressure on home prices. Sales Speed: This looks at how quickly homes go from listed to pending sale. Quick sales are a sign of high demand. These factors, working in combination, reveal areas that are not only desirable now, but are predicted to maintain that momentum. The fact that only four cities from last year's list have remained shows a clear shift in market dynamics, further highlighting the importance of staying on top of these changes. The Top 10: a closer look Here are the 10 metro areas that Zillow has identified as the hottest by 2025: Range Metropolitan area Expected growth in home values (2025) Typical value of a home (2025) Days until pending sale 1 Buffalo, New York 2.8% $267,878 12 days 2 Indianapolis, Indiana N/A $285,086 14 days 3 Providence, Rhode Island 3.7% N/A 12 days 4 Hartford, Connecticut, USA 4.2% $378,693 7 days 5 Philadelphia, Pennsylvania 2.6% N/A 11 days 6 St. Louis, Missouri 1.9% $254,847 8 days 7 Charlotte, North Carolina 3.2% $389,383 20 days 8 Kansas City, Missouri, USA 2.7% $307,334 9 days 9 Richmond, Virginia, USA 2.9% N/A 9 days 10 Salt Lake City, Utah, USA 23% $555,858 19 days Source: Zillow Let's review each city: 1. Buffalo, New York: Buffalo He is a champion repeater. The city's resilience, its unique blend of urban living and natural wonders like nearby Niagara Falls, and its relatively affordable housing continue to attract people. While growth is expected to slow slightly, the market remains competitive and homes are coming off the market. in just 12 days. Buffalo has always intrigued me. It has a very attractive 'comeback' feel to it, like it's really discovering things as a city and people want to be a part of that. 2. Indianapolis, IN: To be honest, I'm surprised to see this area on the list. But a coastal city, with its central location and a strong job market, particularly in the pharmaceutical sector with the presence of Eli Lilly, are likely the factors contributing to the city's growing popularity. Houses in Indianapolis move pretty fast, on average two weeks pending sale. While this is tilted slightly towards the buyers side, it is still a very fast pace. 3. Providence, Rhode Island: This city wonderfully combines history, art and education. It seems that the charm of its waterfront parks and the presence of Brown University and the Rhode Island School of Design are a big draw. 12 days That's all it takes for homes here to sell. 4. Hartford, Connecticut: City home values are forecast to have the biggest growth on this list, in 4.2%although this is actually slower than last year's whopping 7.4% hop. With homes leaving the market at an average of only 7 daysPotential buyers should have their financing arranged in advance. I think the fact that it is close to other major cities in the region is also a factor. 5. Philadelphia, Pennsylvania: Philadelphia is a city with a deep historic and walkable presence. While the market is not as hot as last year, a 2.6% growth forecast and homes pending entry 11 days It means buyers still need to be prepared to act quickly. Philadelphia is a great place; I can totally understand why people want to live there. 6. St. Louis, Missouri: Affordability remains a key draw for St. Louis, especially for first-time buyers. With the lowest typical home value listed in $254,847is 1.9% The growth forecast is a modest jump, while homes are selling at about 8 days. It also seems like a great city to live in. 7. Charlotte, North Carolina: Charlotte, known as the “Queen City,” has a lot going for it: warm weather, plenty of sports teams, and a growing population. A projected 3.2% The increase in home values combined with a 20-day sales average shows a fairly competitive market. Personally, I always thought Charlotte was an underrated city. 8. Kansas City, Missouri: A place of culture, known for its barbecue, musical history and impressive fountains, Kansas City is projected to see a 2.7% increase in home value and an average sales time of only 9 days. Kansas City's historic atmosphere, combined with its affordability, can definitely make it a hotspot for many people. 9. Richmond, Virginia: Virginia's historic capital offers a rich social, dining and arts scene. Buyers will need to be alert as homes sell quickly in an average of 9 days. The city market is expected to grow 2.9%. I think Richmond has a certain charm that can be very attractive. 10. Salt Lake City, Utah: Salt Lake City made the list because of its proximity to outdoor activities, especially skiing. With an average home value of $555,858It is the most expensive market on the list. 19 days is the

Top 10 Real Estate Markets by 2025: Zillow Predictions Read More »