Mortgage Rate Forecast for October 2024: Expert Predictions

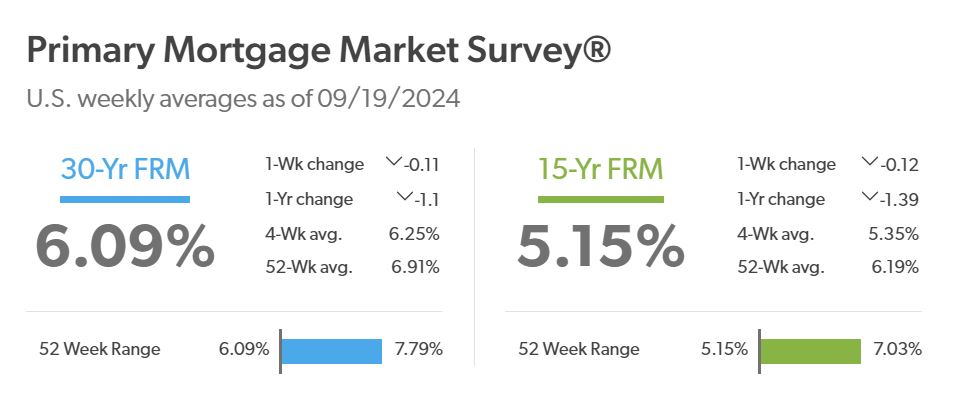

As we look to the future, October 2024 the forecast for mortgage interest rates indicates a possible drop. By the end of October, many experts predict that mortgage rates could be around 5.95% to 6.25% for the 30-Year Fixed Rate Mortgage (FRM). This forecast is driven by several economic factors, including changes in Federal Reserve policy and inflation rates that could influence homeowners’ decisions in the coming months. Mortgage Interest Rate Forecast for October 2024 Key points Current trends: Mortgage rates have come down recently, with the latest average at 6.09% for FRM of 30 years. Projected rates: At the end of October 30-year fixed mortgage rates could range between 5.95% and 6.25%. Economic factors: Developments related to economic growth, Federal Reserve policies, and inflation will have a significant impact on mortgage rates. Impact on the Home buyer: Lower rates could encourage more first-time homebuyers to enter the market. Understanding the current mortgage rate environment The mortgage market always seems to have an air of unpredictability to it. Currently, homeowners and potential buyers are keeping a close eye on economic indicators and announcements from the Federal Reserve. The latest available data from the Federal Reserve Primary Mortgage Market Survey® indicates that the average 30-year fixed mortgage rate as of September 19, 2024, is 6.09%, below the highs reached at the beginning of the year. According to Freddie Mac, as of 09/19/2024, there was a change in 1 week of -0.11% and a One-year variation of -1.1% reflecting improved borrowing conditions for homeowners. Mortgage interest rates are expected to continue their downward trend through October 2024, with several experts predicting rates will be in the 5.75% to 6.5% range by the end of the year. Below is a detailed breakdown of current expectations. Source: Freddie Mac Factors that influence mortgage rates Understanding why rates fluctuate is critical for anyone involved in the real estate industry. Here are some of the most important factors influencing mortgage rates for October 2024: Economic growth The performance of the economy plays a key role in determining the Federal Reserve’s interest rate decisions. As the economy grows, inflation tends to rise. Although inflation has shown signs of stabilizing, any unexpected increase could prompt the Federal Reserve to adjust its policies. Federal Reserve Measures There has been speculation recently about possible rate cuts by the Federal Reserve by the end of the year. If these cuts occur, they could lead to a decline in mortgage rates. The CME Group anticipates an almost 50% chance that the federal funds rate could fall to between 4% and 4.25%. Ultimately, these measures could reduce borrowing costs for families looking to purchase homes. Inflation and consumer spending Inflation remains a thorn in the side of economic stability. Although recent data suggest a moderate outlook, any sudden increase could lead the Fed to reassess its approach. If consumer spending slows after a subsequent increase in mortgage interest rates, housing demand could also fall, leading to further tightening. Housing supply and demand In many regions, the balance between housing supply and demand remains tense. With fewer new constructions and a shrinking stock of existing homes, demand continues to push prices and rates higher. So, if rates fall, demand is stimulated, giving potential homeowners a clearer path to property purchase. Impact on homebuyers in October 2024 For potential homebuyers, lower mortgage rates can mean substantial savings and increased affordability from 6.09% to a projected 5.95% may seem like a minor thing, but over the course of a 30-year mortgage this difference can translate into thousands of dollars. Additionally, if first-time buyers act quickly and take advantage of projected lower interest rates, they can secure homes before the market becomes saturated again. With more people likely to enter the housing market, it is essential for buyers to be prepared and informed about how these changes could affect their purchasing power. Regional variations It’s important to note that mortgage rates can vary significantly across regions. Some markets may experience more fluctuations based on local economic conditions and real estate dynamics. Therefore, potential buyers should pay attention to the specific conditions in their market in addition to national trends. Market sentiments and predictions Analyzing the market can be overwhelming for many people. Recent predictions, such as those of the Business information and CBS News show a collective belief that rates will trend lower through 2024 and potentially into 2025, with some outlooks indicating rates will possibly fall below 6% in the coming months. Experts’ predictions: The Mortgage Bankers Association predicts an average mortgage rate of 6.5% by the end of 2024. Fannie Mae anticipates a slightly lower average of 6.4% for the same period. Other analysts suggest rates could stabilize between 5.75% and 6.0%, depending on economic conditions and future Fed actions. These forecasts reflect a consensus among analysts on the direction of the economy and consumer interest rates, promising several more months of favorable credit conditions for potential home buyers. My opinion on the forecast I believe the next few months will reveal crucial information about home financing. The combination of a slower economic growth rate and the planned actions by the Federal Reserve indicate a positive trend for those seeking a mortgage. It is an exciting period for first-time homebuyers, and I encourage those who have been on the fence to consider entering the market. Several markets are experiencing a slowdown as homeowners postpone selling, waiting for more favorable conditions. This balance contributes to price stability in many areas, making now a good time for first-time buyers to get a loan before prices possibly rise again. In short, the Mortgage interest rate forecast for October 2024 is that the housing market is evolving, and expectations of lower rates provide hope for many potential buyers. By understanding the dynamics that influence these rates (such as economic conditions, Federal Reserve initiatives, and regional market variations), individuals can make well-informed decisions about their future in the housing market. Frequently Asked Questions 1. What is the current average mortgage interest rate? As of September 19, 2024, the

Mortgage Rate Forecast for October 2024: Expert Predictions Read More »