San Francisco Housing Price Chart

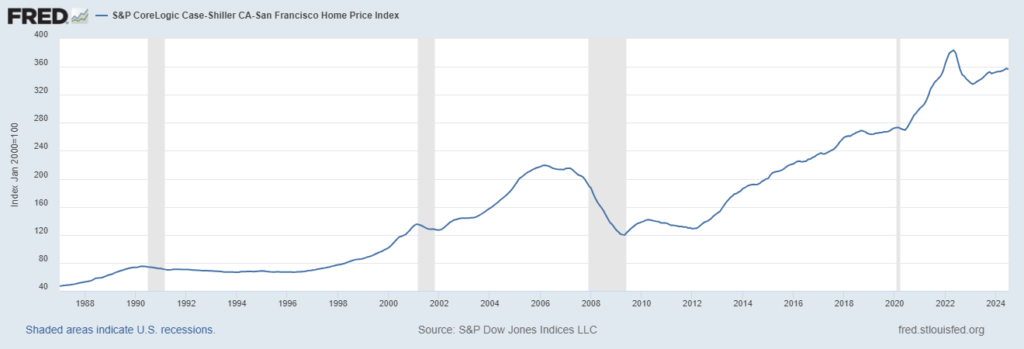

Do you want to know the real story behind Housing Prices in San Francisco? Let’s delve into the data and explore the ups and downs of this famous and expensive market. The San Francisco Housing Price Chart reveals a complex picture, much more than simply rising costs. San Francisco Housing Price Chart Source: FRED The San Francisco real estate market is notoriously challenging. Limited space, high demand and strict building regulations contribute to the high prices. It’s not just about buying a house; It also affects renters, creating a constant struggle for affordable living. The data we will see comes from S&P CoreLogic Case-Shiller CA-San Francisco Home Price Index, a reliable source that tracks changes in home prices over time. It is essential to use reliable data to understand this complex situation. The S&P CoreLogic Case-Shiller Index The S&P CoreLogic Case-Shiller Index gives us a clear idea of how House Prices in San Francisco have changed since 1987. The index uses January 2000 as a base of 100, so you can easily see the percentage increase or decrease from that point. The data is seasonally adjusted meaning it eliminates normal seasonal fluctuations (like higher sales in the spring) to give us a clearer trend. I have personally analyzed this data for years. Believe me, if you want to buy or sell a house here, you need to understand what all those numbers mean. It’s not enough to look at the numbers; you must understand what they are really telling you. Key Periods in the San Francisco House Price Chart Let’s break down some significant periods reflected in the San Francisco Housing Price Chart: 1980s and 1990s: A period of relatively stable and constant growth. While House Prices in San Francisco were already high, the increases were not as dramatic as those we would see later. The dotcom boom (late 90s and early 2000s): The explosive growth of the technology industry dramatically increased Housing Prices in San Francisco. This era saw a significant upward swing in the index, reflecting the influx of wealthy tech workers. The housing bubble and bust (2000s): Like many areas, San Francisco experienced a housing bubble, which caused extreme price increases followed by a sharp correction during the 2008 financial crisis. The index shows a notable decline during this period. Many lost significant amounts in their homes. The post-recession recovery and beyond (2010s to present): After the Financial Crisis, Housing Prices in San Francisco bounced hard. The technology boom continued and limited housing supply continued to drive prices higher. The last decade shows continued growth, although at a slower pace than the peak years. Data Table: S&P CoreLogic Case-Shiller CA-San Francisco Home Price Index (select years) Year Index value (January 2000 = 100) 1987 46.96 1997 69.64 2000 101.45 2007 214.62 2008 186.63 2012 128.64 2017 235.26 2022 364.61 2023 336.92 2024 356.29 (Note: This table shows years selected for brevity. complete data set contains monthly values from 1987 to 2024.) Factors influencing housing prices in San Francisco Many factors play a crucial role in shaping the House Prices in San Francisco: Limited housing offer: San Francisco has a geographically restricted area, which limits the potential for new construction. Strict zoning laws and lengthy permitting processes further restrict construction. High demand: The city’s attractiveness as a place to live and work contributes to sustained high demand for housing. This demand comes from both local residents and those moving from other areas. Economic growth: The city’s strong economy, particularly its technology industry, significantly affects housing affordability. High-paying jobs attract people who can afford to pay high prices. Interest rates: Interest rates influence how many people can afford to buy a home. Low interest rates tend to drive up prices. High interest rates can reduce demand and moderate price increases. Government regulations: Local regulations on housing development and construction play an important role in shaping the real estate market. Regulations aimed at preserving the city’s character can make it difficult to increase supply. Personal observations Based on years of tracking the San Francisco real estate market, I can offer a personal perspective. While the recent slight drop may seem like a significant change, it is crucial to keep the bigger picture in mind. Housing prices in San Francisco remain significantly higher than they were a decade ago. We can see the influence of economic cycles in the data, with periods of rapid growth followed by corrections. However, underlying factors (limited supply and high demand) continue to put upward pressure on prices. My expectation is that, despite fluctuations, we will see continued pressure to increase prices over the long term unless there are significant changes to the city’s planning and development policies. The future of housing prices in San Francisco Predicting the future of Home Prices in San Francisco is a challenging task, even for seasoned professionals. The city faces complex issues that will continue to impact the market. While the current level of price growth is likely to slow in the coming years unless building regulations are relaxed and more homes are built, there will still be high demand for real estate, so the prices will likely remain very high. Related articles: House price graph over the last 20 years USA 50 Year Real Estate Market Chart – Shows Price Growth San Diego real estate market graph 50 years: analysis and trends California real estate market graph 50 years Average house prices per year in the United States Average increase in home value per year, 5 years, 10 years How much did house prices fall in 2008? 2008 Real Estate Crash Explained: Causes and Effects The publication San Francisco Housing Price Chart appeared first on Norada Real Estate Investments.

San Francisco Housing Price Chart Read More »