Prices will rise 4.4%

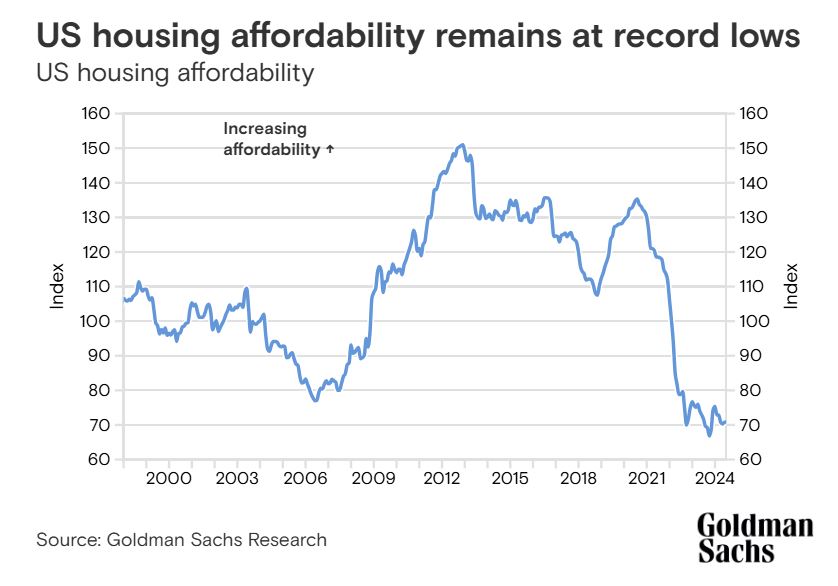

Imagine the hustle and bustle of a busy city where people are always on the go, especially when it comes to buying homes. Goldman Sachs predicts home prices will rise more than 4% in 2024 and 2025a projection that many are following closely as the real estate market continues to show signs of life. With factors such as changes in interest rates and the fluctuating job market at play, this forecast raises many questions about what it means for home buyers, homeowners and those looking to invest in property. Real estate market forecast for next year: prices will rise by 4.4% Key takeaways: House prices in the US they are expected to increase 4.5% in 2024 and 4.4% in 2025. Lower interest rates due to Federal Reserve Stocks are driving this rise. He housing supply remains limited, contributing to continued price appreciation. Recent mortgage rate decreases have not yet led to a significant increase in applications. different United States regions are experiencing varying levels of price growth, with the Midwest and Northeast showing the strongest increases. US Real Estate Market Outlook 🏠 House prices is expected to increase 4.5% in 2024 4.4% in 2025 📉 Interest rates Lower rates due to Federal Reserve behavior 📦 Housing offer remains limited contributing to price appreciation 📝 Mortgage applications No significant increase despite the recent the rate decreases 🗺️ Regional variations Midwest and Northeast demonstration stronger increases The real estate market has always been influenced by a multitude of factors, and recent analysis from Goldman Sachs sheds light on what the future could hold. Goldman Sachs analysts They have increased the price of their home appreciation forecasts based on several vital factors, stating that the economy remains strong and interest rates are expected to decline. But what does this mean for the average person? Let's delve into this important topic. Current trends in home prices The market has experienced significant fluctuations as a result of economic conditions and global events. At the start of the pandemic, many feared a drop in property values. Contrary to what was expected, the opposite happened. As many people turned to homeownership during the lockdowns, demand for housing increased. This caused an unprecedented rise in prices, which peaked around 20% annually. Recently, annual house price growth has stabilized around 5.5%hinting that demand is far from satisfied, especially with a demographic increase of potential buyers looking for homes in the age group of 30 to 39 years who are forming families. Interestingly, the cost of mortgages has seen a substantial decline, from a peak above 7.8% in October 2023 unless 6.5% recently. This decline in mortgage rates paves the way for more affordable home buying opportunities, allowing more potential homeowners the opportunity to enter the market despite historic affordability challenges. Factors driving house price growth A key factor driving the rise in home prices as forecast by Goldman Sachs is the forecast interest rate cuts by the Federal Reserve. As the labor market shows signs of easing, economists predict that the Federal Reserve will implement multiple rate cuts in the near future. Lower rates mean lower borrowing costs, which in turn makes homes more affordable for buyers even as prices continue to rise. Interestingly, the phrase “bad news is probably good news” reflects the current sentiment in the market. Analysts suggest that concerns about economic downturns may lead to interest cuts that ultimately benefit homebuyers. As employment concerns continue to circulate, it appears that home prices are resilient, and low permanent layoff rates support a stable labor market. The affordability conundrum While home prices are rising, the issue of affordability It is still a hot topic. Current affordability levels are said to be the worst since the beginning of 1980s. The anxiety surrounding rising prices has led many to wonder if potential buyers will be priced out of the market entirely. In the past, affordability issues were often resolved by sudden drops in home prices. However, Goldman Sachs believes that the current scenario may lead to a more gradual return to normalized levels of affordability. With mortgage rates expected to continue to decline and real disposable incomes to grow modestly, there may still be hope for buyers looking to enter the market. Regional variations in house prices Projected growth in home values is not uniform across the United States. According to Goldman Sachs, some regions are experiencing much healthier appreciation rates than others. He MidwestOften recognized as the most affordable part of the country, it is seeing notable price increases, particularly in cities like cleveland and chicago. He Northeastwith centers like New York and BostonIt has also shown strong growth in house prices. On the contrary, in Californiamarkets like san diego are thriving, despite historic concerns about affordability challenges. Meanwhile, the Southeastespecially Floridahas shown a drop in affordability that challenges its previous status as a budget destination. The future of home prices and the economy Looking ahead, Goldman Sachs has expressed optimism about the housing market and expects it to remain buoyant with 4.5% growth in 2024 and 4.4% in 2025. There are a couple of factors contributing to this positive outlook. First, the anticipated interest rate cuts It seems likely to encourage buyer activity when it comes to mortgages. Analysts predict that reductions in borrowing costs will help buyers who have been on the fence for quite some time. Second, while affordability issues persist, revenue growth It is expected to remain positive, providing more purchasing power to buyers. The challenge remains to see whether these factors will create a balance, stabilizing the market without resulting in a drastic drop in house prices. Consumer sentiment and market anticipations Despite notable changes in mortgage rates, the market has yet to see an increase in mortgage applications. This stagnation could be due to a combination of seasonal predictability and buyers' hesitancy to jump into a fluctuating market. As families begin to settle into a routine with school-aged children, it is common for many to decide not to move during this

Prices will rise 4.4% Read More »