How long will it take to sell my house?

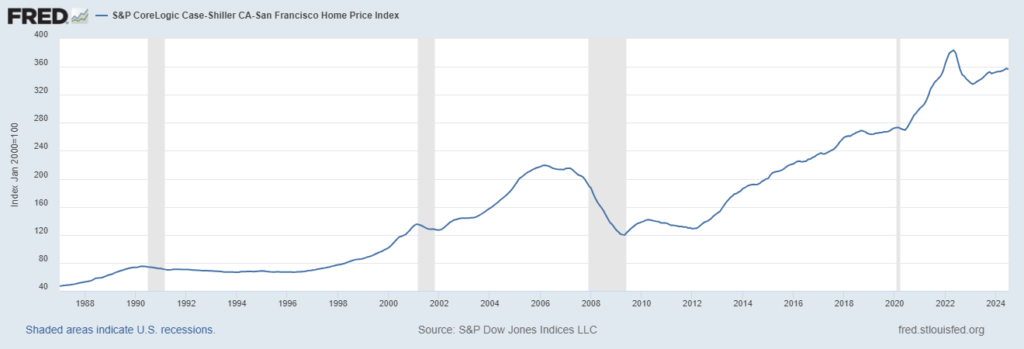

Last updated on November 6, 2024 Housing inventory recently hit a 4-year high in September, as the lower-than-low housing inventory levels we experienced during the pandemic are slowly fading as more and more homes come to market. What's more, new homes for sale have increased 4.7% nationally, despite the headwind of mortgage interest rates. With more listings than we've seen in recent years, if you're selling or about to sell, you may be wondering what to expect in terms of how long the entire process might take, from start to finish. It's a good idea to manage expectations when listing your home, and to that end, here's what we're seeing both nationally and locally in terms of average days on market (DOM). DOM national average Today, what's happening nationally is just a snapshot of what's likely happening in your area, as real estate becomes increasingly hyperlocal. At the national level, the latest data shows us that days on market are 55 days. This figure is much higher than the average 48 days on market we experienced this time last year, when inventory shortages were a much bigger issue than today. However, while DOMs have increased year over year, time on market is still well below the averages we saw in the pre-pandemic market. In 2017, days on market were around 64 days, and this was during a seller's market. Regional average DOM Locally, here's what we're seeing in our markets (based on Q3 data): Charlotte: 44 SUN Triad: 42 SUN Triangle: 40 SUN Upstate: 50 DOM Mountain lakes: 77 SUN Asheville: 70 SUN Highlands: 161 SUN What does all this mean for sellers? Even as days on market slowly inch toward pre-pandemic levels, the issue remains: There are still more buyers than sellers. A home that is priced well from the start, has been well maintained, and is properly staged and marketed will sell quickly. As you prepare your home to list, here are some tips to keep in mind: Correct price Even in a seller's market, homeowners should not “test the market” by pricing their home too high. Buyers are getting smarter and, with all the data at their fingertips, they know when something is overpriced. An overpriced home is sure to stay on the market longer than its properly priced counterparts, and when this happens, it leads buyers to ask the question: “What's wrong with that home?” This is still a fast-paced market and buyers take notice when the same home keeps showing up in their search, week after week. Testing the waters with price ends up backfiring, forcing sellers who try this strategy to significantly lower the price of their home. TLDR: Homes that are well priced and in good condition are still oversubscribed and receive multiple offers. Therefore, it's important to price your home right from the start. Instead of pricing your home based on what you think it's worth, let the market determine the sales price for maximum exposure. stage to sell You've heard the saying, “A house staged is a house sold,” and these famous last words echoed by real estate agents around the world couldn't be more true. Homes on the market that are under contract days after listing are impeccably staged. All surfaces are free of clutter. All closets are organized and have about 1/3 of the space empty. All extra rooms and garages are collected and organized to show their potential. All the walls are painted in light, cool neutrals and the curb appeal is so good it practically invites you in for a hot cup of tea. If you need information on elements and practical tips for staging, be sure to check out: How to prepare your garage to sell it. ________________________ Allen Tate is the largest real estate company in the Carolinas with more than 70 offices and 1,800 real estate agents in the Charlotte, Triad, Triangle, High Country, Upstate SC, Highlands/Cashiers and Asheville/Mountain regions. Allen Tate is a partner at Howard Hanna Real Estate, the largest private real estate brokerage in the U.S., with 500 real estate, mortgage, insurance, title and escrow services offices and 15,000 sales associates and staff. in 13 states. For more information, visit www.allentate.com and www.howardhanna.com. Visited 3 times, 3 visits today

How long will it take to sell my house? Read More »