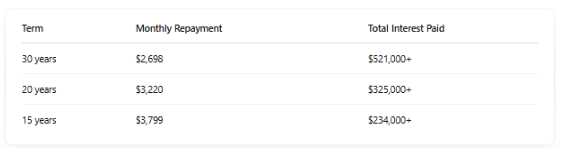

The purchase of investment property depends on many factors, which include the type of property, the mortgage term, the location, the mortgage rate, etc., the mortgage period is very important, because you can define the amount for which you can qualify and your mortgage payment plan. Know that the mortgage terms are classified into two options: short -term and long -term mortgage. Then, in this article, we will discuss one of these: the short -term mortgage. What does it mean? What are the pros and cons? And what are the factors to consider before opting for this mortgage term? What is a short term mortgage? Short -term mortgages are types of unconventional loans. These types of mortgages mature in less than 15 years. Unlike conventional loan, which takes an average of 30 years to expire, these types of loans allow owners to pay their mortgage faster and generate capital in the property in a shorter period. Although short -term mortgages offer several benefits, there are some other things that you should know before making your decision. In the next sections, we will discuss everything you need to know about this type of loan and its pros and cons. How does a short -term mortgage work? Meanwhile short-term loans are similar to long -term loans in structure, with the latter taking more time to pay off than the former. Then, unlike long -term mortgages, which take about 30 years to mature, a short -term mortgage takes a maximum of 15 years to reach expiration. That means that the owner can pay his loan in a shorter period and generate capital in the property. In addition, the short expiration period of short -term mortgages allow you to pay the loan quickly. That means that this type of mortgage is usually less risky compared to long -term mortgages. For this reason, the mortgage rate is lower than that of conventional loans. So, although you are paying more in monthly payments of the mortgage, its total is significantly lower than long -term mortgages. Advantages of short -term mortgages As we have discussed, the common advantage of a short -term mortgage is that a shorter period is needed to mature than a long -term mortgage. While this is a significant reason, there are other benefits of short -term short -term mortgage. Here, we will discuss these others less obvious from short -term mortgages. Low interest rate The lenders consider that short -term mortgages are less risky due to the time it has to mature. Due to the short expiration period, lenders tend to recover their investment and profits faster. And so, since it is not as risky as the conventional mortgage, the lenders are generally less strict on the loan and reimbursement requirements. Most short -term mortgages are generally not secured by government agencies (such as Fannie Mae, Freddie Mac, Fha, Va, etc.). In addition, the owners are not obliged to make some payments (such as private mortgage insurance (PMI), etc.). It takes less time to pay the loan By observing the monthly payment of the mortgage of both terms of the mortgage (the long term and, most owners will prefer to opt for a long -term mortgage loan, because your monthly mortgage payment is cheaper. However, a deeper look in terms (short and long term mortgages) will show that although the short -term monthly mortgage payment is more expensive, the total payment is usually significantly cheaper for short -term loans. Helps build faster equity Since short -term mortgages take less time to pay, you can quickly pay your mortgage and generate capital in the property in a short period. For example, the equity you will have in your home with a loan of 15 years after five years of mortgage payments, will be significantly greater than the capital that would build in a 30 -year mortgage in the same period. Disadvantages of short -term mortgages Knowing only the advantages of a short -term mortgage loan is not sufficient to make informed decisions. Although the benefits can be convincing (low interest rate, shorter payment schedule, faster construction capital, etc.), knowing the disadvantages will help you make better real estate investment decisions. Higher monthly mortgage payment You will likely be asked to pay a higher monthly mortgage. In our previous example, a 15 -year mortgage period requires that you pay $ 2,334 in monthly mortgage, while a 30 -year mortgage requires that you pay only $ 1,701 monthly. Then, instead of paying a lower amount, obtaining a short -term mortgage loan means that it would pay a higher monthly mortgage. A shorter loan period will compensate for the highest monthly payment of the mortgage. Less affordable A short -term mortgage is less affordable because you (the borrower) could be limited to specific properties depending on the approved limit of the lender. For example, if the lender only approves the borrower to take a mortgage of $ 2,000 per month for the monthly mortgage payment. Using the previous example, the owner will not qualify for the loan with a period of 15 years because the monthly payment of $ 2,334 exceeds the $ 2,000 limit per month. However, they will only qualify for a mortgage of $ 230,000 using the same parameters as previously. While, if the borrower requested a 30 -year mortgage (using the same parameters as the example), the monthly mortgage payment would be $ 1,701, well below the $ 2,000 limit. Less popular Finding short -term loans (such as 5-, 10- and 15-year-old mortgages) requires more work. Short -term loans are less popular among mortgage lenders and borrowers. These types of loans are not conventional, which means that they are types of special loans and may not be available at some lenders. So, if you are looking to opt for a short term of mortgage, you need more research to find them. Higher monthly payments can result in disability of payment Since short -term mortgages require higher monthly mortgages than conventional, most owners