Well, let’s get right to the point: If you’re wondering where the real estate stock will be in 2025, Zillow’s Hottest Real Estate Markets for 2025 are directed by Buffalo, New York as the first predicted position. Yes, Buffalo is once again predicted to be the most competitive market for buyers across the country. But don’t stop there! The real estate landscape is much more nuanced than that of a single city, so let’s dive in and explore what these trends really mean for you.

Why Buffalo again?

It’s not every day you see a city take first place in the real estate rankings two years in a row, but that’s exactly what Buffalo is doing. I know, you might be thinking, “Buffalo? Really?” But trust me, the data doesn’t lie. What’s pushing Buffalo to the top? A potent combination of limited supply and a good number of new jobs entering the area, which creates a recipe for high competition.

Builders are struggling to keep up with the influx of new residents, leaving housing in short supply. And, from what I’ve heard from colleagues, buyer competition never cooled off last year.

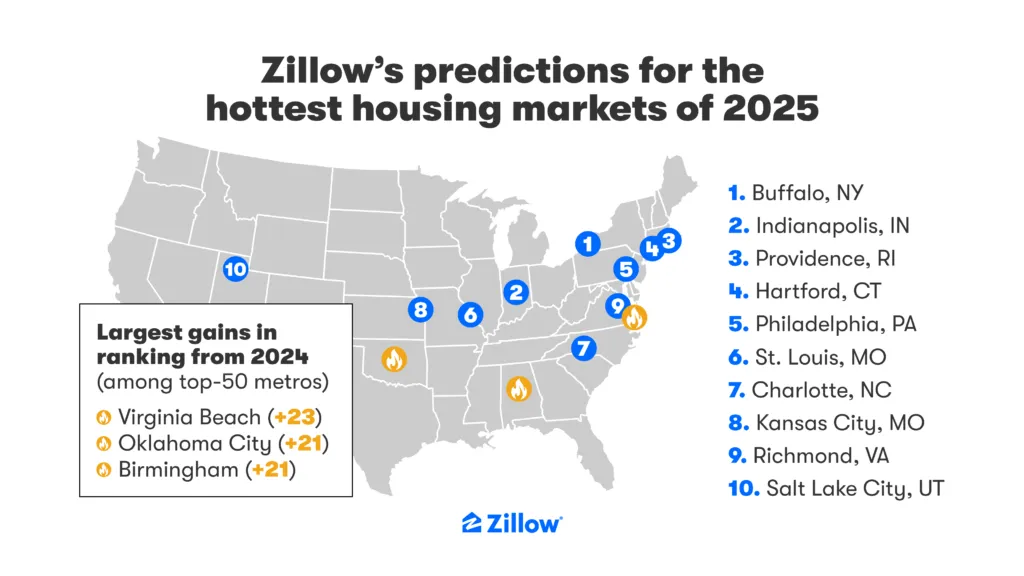

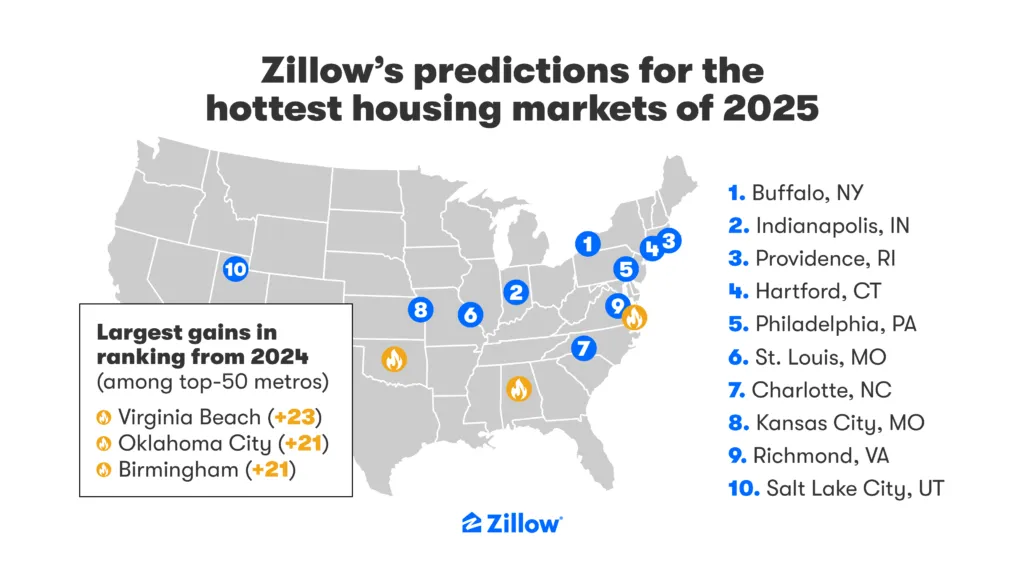

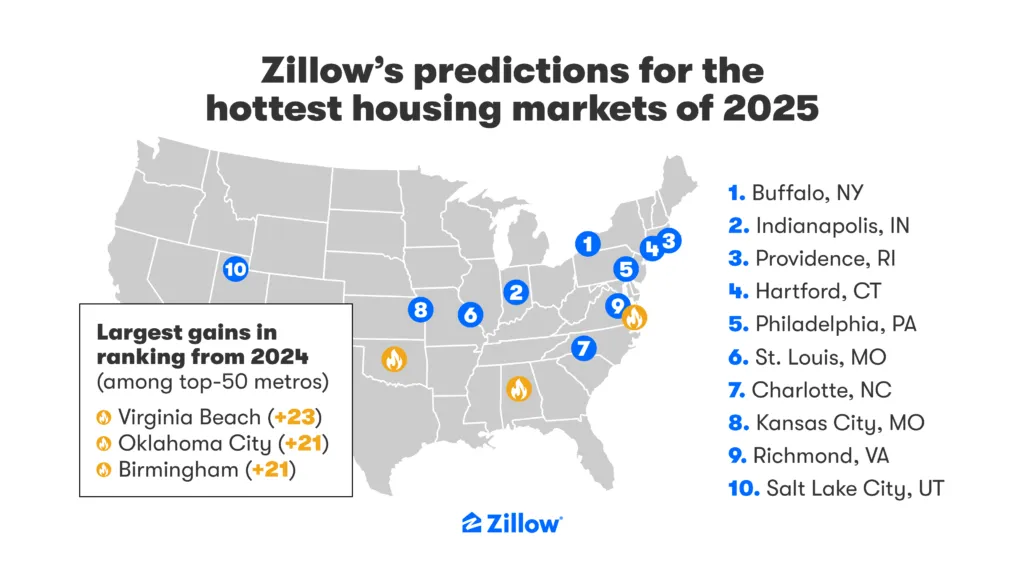

Zillow’s Hottest Real Estate Markets in 2025: Latest Predictions

Beyond Buffalo, there are other cities poised for significant growth, so if Buffalo isn’t your thing, there are plenty of options. Let’s take a look at Zillow’s The 10 hottest real estate markets by 2025, according to their latest forecast:

- Buffalo, New York

- Indianapolis, Indiana

- Providence, Rhode Island

- Hartford, Connecticut, USA

- Philadelphia, Pennsylvania

- St. Louis, Missouri

- Charlotte, North Carolina

- Kansas City, Missouri, USA

- Richmond, Virginia, USA

- Salt Lake City, Utah, USA

What catches my attention about this list is the geographical diversity. It has strong contenders from the Northeast, the Midwest, and even a presence from the South and West. It tells us that this trend is not just localized but a broader change, reflecting different dynamics across the country.

What is driving these markets?

So what’s the secret ingredient behind these promising cities? Well, it’s more than just one ingredient:

- Affordability: Many of these markets offer a relatively lower cost of living compared to major metropolitan centers such as New York City or Boston. It’s no surprise that cities like Providence and Hartford, quite close to those megacities, are seeing a surge in popularity. It seems that people are looking for a balance between career opportunities and manageable living expenses.

- Job growth: A booming job market is a sure sign of a strong housing market. Places like Buffalo, which has seen a substantial increase in employment opportunities compared to new housing permits, will naturally be hot spots. It is a classic case of demand exceeds supplywhich can raise prices and create competition among buyers.

- Demography: Both baby boomers and millennials are active players in the housing space, and by 2025, 42 of the 50 largest markets are expected to experience an increase in homeownership. Austin, Orlando and Jacksonville are especially expected to experience a major boom in the sales market. However, places like Birmingham, Hartford and Oklahoma City are expected to see a drop in the number of homeowners. This demographic shift suggests that there are many potential buyers eager to enter the real estate market.

- Home value growth While many markets are expected to have positive appreciation, some have very slow growth. Indianapolis, for example, is expected to see its home appreciation grow from 2.8% last year to 3.4% in 2025. In other cities like Buffalo, appreciation is expected to fall from 5.8% in 2024 to 2.8% in 2025. It’s worth noting that even the best-performing markets can look tame in terms of numbers, compared to the huge price growth we saw in 2021 and 2022.

The biggest jumpers and droppers

It’s not just about the top 10; it’s about movement within the ranks. Virginia Beach made the biggest jump, rising 23 spots from last year’s list. This jump is mainly due to a significant increase in employment growth that far exceeds the number of new homes being built.

On the other hand, Memphis experienced the biggest drop, falling 30 points as new home construction has outpaced low job growth in the area. This tells a very simple but important story: a healthy housing market needs to have a balanced mix of job opportunities and housing supply.

Cooling markets to take into account

While many areas are warming up, there are some markets that are expected to cool down. cities like New Orleans, San Francisco, San Jose, Portland and Austin They are expected to have weak demographic and labor market pressures, stagnant or falling home values, and are expected to see slow growth. In fact, even places like New Orleans are expected to experience a decline in home values! It just goes to show that not all markets follow the same trend and that there is much more to this equation.

What this means to you

Whether you are an experienced investor or a first-time home buyer, this information is important. Here’s what you should keep in mind:

- For buyers: If you’re targeting one of these hot markets, prepare for competition. You may want to get pre-approved for a loan and consider working with an experienced agent who understands the dynamics of the local market. Be prepared for a potentially expedited process and be prepared to act quickly.

- For sellers: If you own a property in one of these high-demand areas, it’s probably a good time to sell it. However, don’t be too greedy and work with a good real estate agent who can help you value your property correctly and get you the right offers.

- For investors: Understanding these trends can guide your investment decisions. These markets are worth exploring. Personally, I think it’s likely that places like Buffalo, despite the slowing rate of appreciation, will still offer promising returns, especially if they are able to continue retaining and attracting talent and expanding their labor markets.

The numbers behind the predictions

Zillow uses a complex methodology to create its listing. They take into account things like:

- Home Value Appreciation: They analyze the expected growth in home values and the acceleration of home value appreciation.

- Market speed: This is how quickly homes sell in the area, usually measured by the number of days a home remains on the market.

- Demographic trends: They assess projected changes in owner-occupied households and take into account aging populations and migration patterns.

- Labor market: Labor market data is used to see how job growth or decline can influence housing markets.

- New construction: The number of new construction permits in an area is a critical element in estimating the future growth of the real estate market.

Using these metrics, Zillow can predict which areas are likely to experience the most significant growth and demand next year.

My two cents

While these predictions are valuable, always remember that the real estate market is dynamic and many things can change. Interest rates, local policies, and even national events can influence these trends. So while Zillow’s listing is a good starting point, I always recommend doing your own research and consulting with local real estate professionals. I feel that in the long run, having expert advice from an on-the-ground resource will always be helpful in addition to these predictions.

Final thoughts

Zillow’s Hottest Real Estate Markets for 2025 offer a glimpse of where the action in real estate is likely to be, but it’s more than just numbers. There are real people and real life stories behind every transaction. Whether you are looking to buy, sell or invest, it is essential to stay informed and adapt to the ever-evolving real estate market.

Work with Norada in 2025, your trusted source for

Turnkey real estate investment

Discover high-quality ready-to-rent properties designed to offer consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment advisors (No Obligation):

(800) 611-3060