Refinance at a shorter loan period and free yourself faster

Still in a 30 -year mortgage? You may pay too much in interest in hundreds of thousands. Here we show you how to solve it.

When most Australians obtain a mortgage loan, they contain a period of 30 years without thinking twice. It feels normal. But the normal thing is not always intelligent, especially when your goal is to pay your home fast.

Refinanizing a shorter loan period, such as 25, 20 or even 15 years, is one of the most aggressive but effective ways to accelerate its path to financial freedom. And for many members and veterans of the ADF, this strategy fits perfectly to professional milestones, family planning and long -term objectives.

In this publication, we will explore how this powerful movement works, what to consider and why it could be the change of play you have been looking for.

Why do the shortest loan terms work

When refinance to a shorter loan period:

- You reduce you Total interest paid.

- You pay your house faster.

- You build Faster equitythat opens investment options.

- Take control of your financial future before.

Yes, payments are higher, but for many ADF members with regular income, assignments and benefits of DHOAS, that is not only manageable, it is intelligent.

How much could you save?

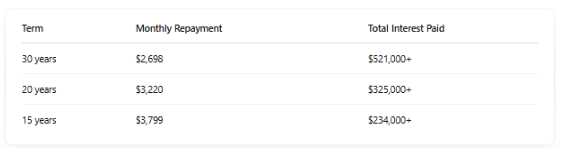

Let's compare a mortgage loan of $ 450,000 with 6% interest:

Fall for 15 years and could save almost $ 300,000 in interest. That is not a typographic error.

What makes this ideal for ADF members?

- Your income is regular and stable. Perfect for greater payments.

- It is possible that you already receive Dhoas subsidies. That is extra money to help cover the cost.

- You are used to budgeting and discipline. You have what is needed to continue with a structured plan.

In addition, if you are still in service, it is likely that you Life costs are lowerWhich means that now is the ideal time to increase your financial strategy.

When to refinance a shorter term

Refinancing works better when:

- Your income has increased or your budget has space.

- He has paid part of his loan and can handle a slightly higher refund.

- You are motivated to be mortgage free before retirement or transition outside the ADF.

Hack life: If you are 3 years now and you move within 15 years, you could be mortgages for 50“You are still locked up for another decade.”

Concerned about higher reimbursements?

Here is the solution: no have refinance to benefit.

Instead, Keep your loan at 30 years, but pay as if you were a 15 years.

- Set your refund to match a period of 15 or 20 years.

- Make additional payments weekly or fifteen days.

- Automate it and do not touch the surplus.

This provides flexibility (you can reduce payment if necessary) but still delivers most savings.

Steps to refinance in the right way

- Talk to a mortgage corridor Who understands the needs of ADF (we can connect it).

- Check your existing loan and interest rate.

- Evaluate your financial position“Lougiums, bonuses, dhoas and other obligations.”

- Compare loan products In multiple lenders.

- Choose a term (for example, 20 or 15 years) that fits your lifestyle and objectives.

Bonus Council: Combine with capital access

If you have had your property for a few years, you are likely to have grown up. Use that equity:

- To refinance at a better rhythm.

- To finance another investment.

- Or simply reduce the balance of your loan and restructure it smarter.

Conclusion: Pay your home in your terms

Refinanizing a shorter loan period is a bold and strategic movement that separates the financially free from the stagnant financially. If you take seriously the elimination of your early mortgage, it is one of the smartest decisions you can take.

You do not need to be a financial guru. You just need to choose the decision and get the right team behind you.

Do you need a runner who understands the defense?

We have helped thousands of ADF members and veterans to refinance better, structure better and pay their homes before, without sacrificing the lifestyle.

Reserve a free consultation with our team of experts today:

🔗 https://www.inritypropertyinvestment.com.au/property-investing-for-adf/

Or get our final guide:

📈 Wealth through property

🔗 https://www.inritypropertyinvestment.com.au/wealth-through-property/

🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓 🎓

🔗 Click here to register