Are you thinking of buying a house? Or maybe you are the owner of a house, watching the market? Anyway, you probably have wondered if housing prices will continue to climb, or if a dip is on the horizon. While most experts predict modest growth nationwide in 2025, a recent Corelogic report has identified five cities where housing prices are expected to crash within the next 12 months. The cities with the greatest risk of reducing housing prices are: Provo, UT; Tucson, AZ; Albuquerque, NM; Phoenix, AZ; and West Palm Beach, FL.

Let’s see why these particular areas are considered high risk and what factors are contributing to this prognosis.

5 cities where housing prices are expected to crash

Why should you worry about this prediction?

Well, some experts believes that prices will go down in some places. Why should you worry?

- If you are looking to buy: This information could help you decide where to focus your search or when to make an offer. Time can be everything!

- If you already have a house: Knowing if your area is at risk can help you make informed decisions about refinancing, sale or simply adjust your financial expectations.

- Even if you are not on the market: Understanding these trends can give a broader image of the national housing market and the economic factors that influence it.

The Corelogic report: a deep immersion

CoreLogic, a good -reputable real estate analysis firm, not only makes these predictions. Their Market Risk Indicator report takes into account a lot of different factors, which include:

- Economic conditions: Things such as employment growth, unemployment rates and general economic stability in each area.

- Housing supply: How many houses are there in the market? Are there more buyers than sellers (a seller’s market) or vice versa (a buyer’s market)?

- Demand dynamics: What leads people to buy or rent in these areas? Are there factors that could make demand cool?

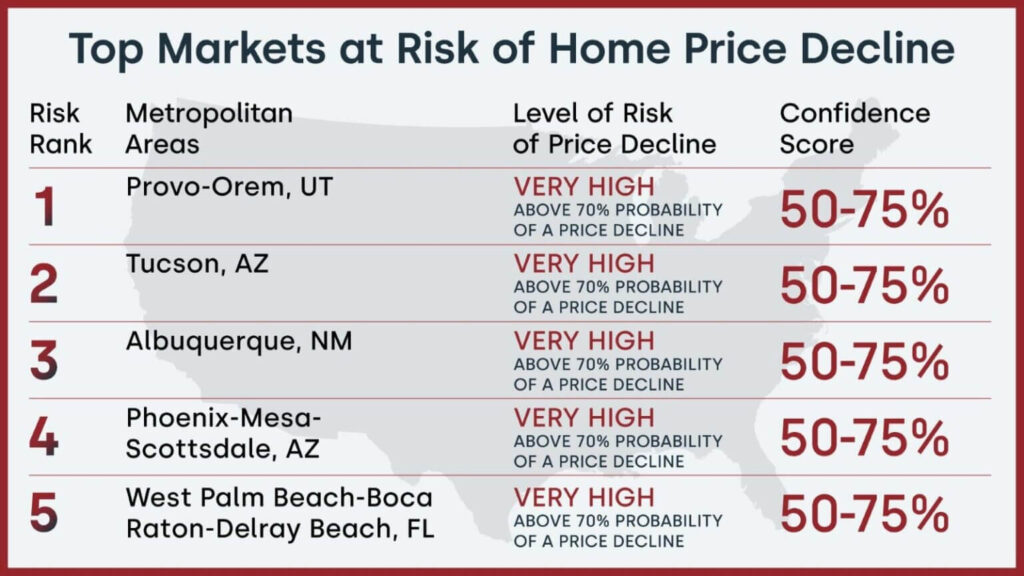

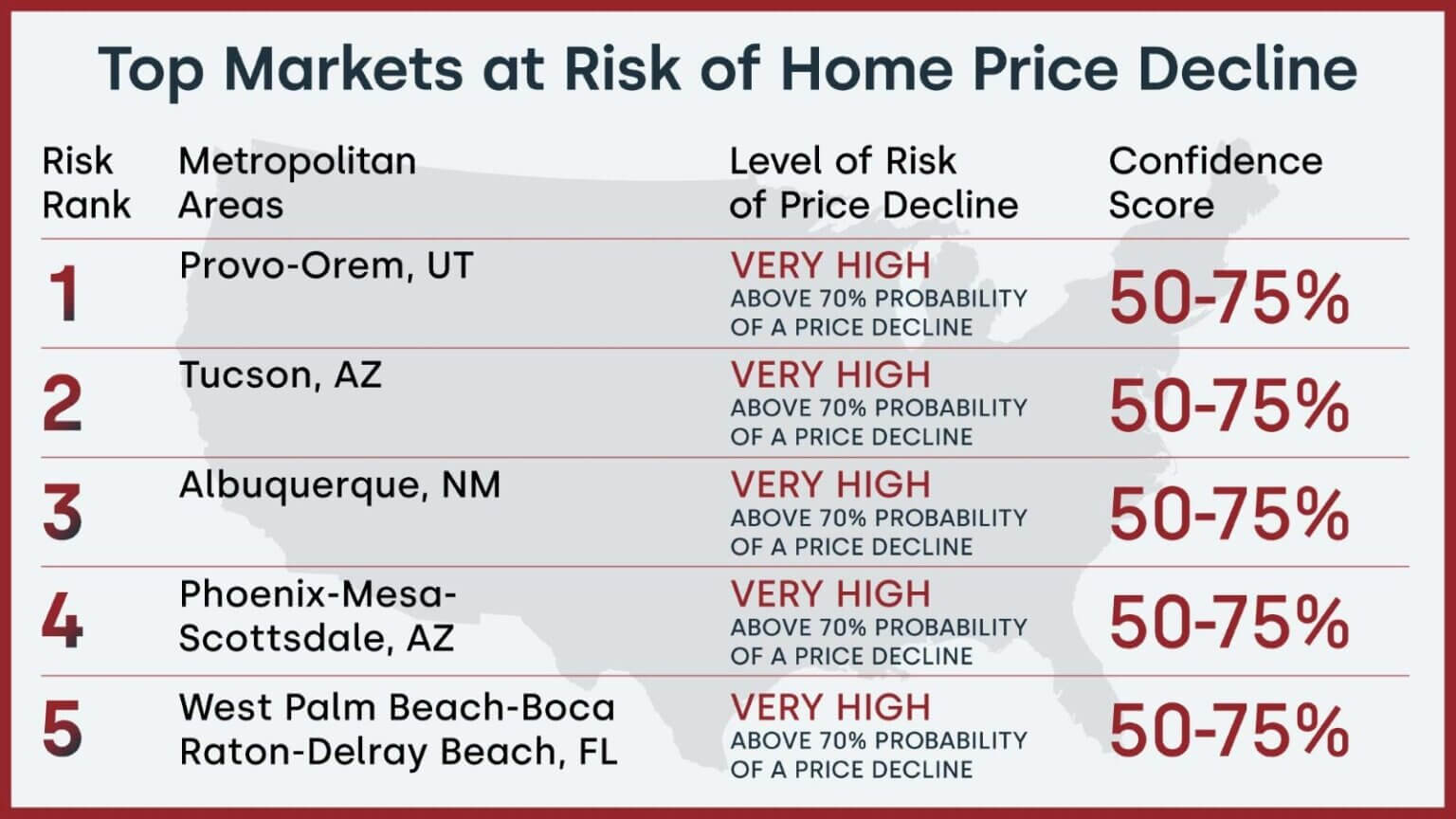

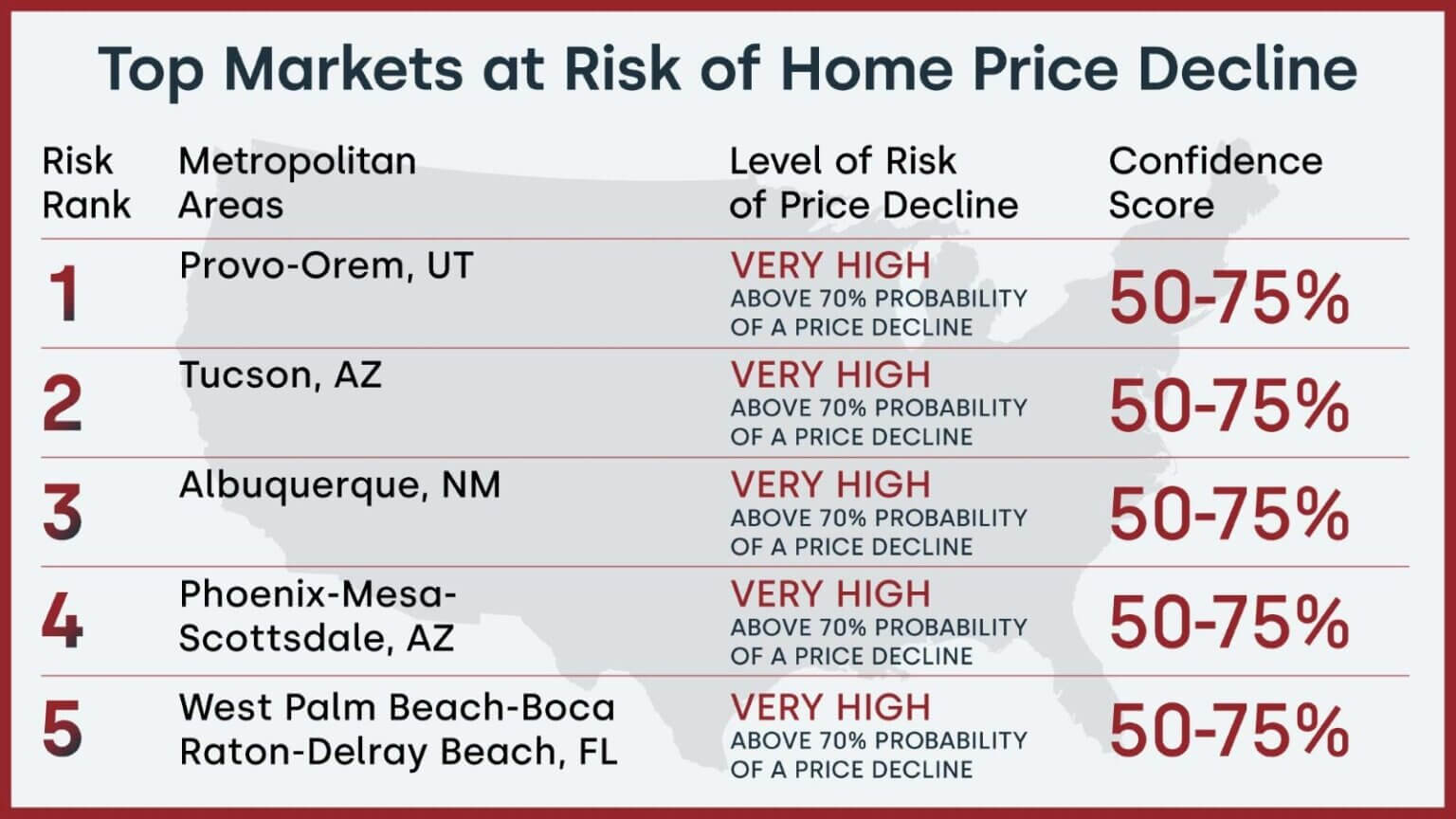

When analyzing this data, Corelogic assigns a probability that the price decreases in different metropolitan areas. A 70% or greater probability, as seen in these five cities, is considered a high -risk scenario.

The Sun Belt Story: boom and (possible) bust?

It is not an accident that the five cities are in the solar belt. The solar belt saw great price growth during pandemic. People moved to these areas for warmer climate, lower taxes and more space. This boom raised housing prices, but, this year could be running out of steam.

Here is an attached image table view on the notice:

| Risk range | Metropolitan Areas | Risk level of price decrease | Trust score |

|---|---|---|---|

| 1 | Provo Orem, UT | Very high above 70% probability of a price decrease | 50-75% |

| 2 | Tucson, AZ | Very high above 70% probability of a price decrease | 50-75% |

| 3 | Albuquerque, NM | Very high above 70% probability of a price decrease | 50-75% |

| 4 | Phoenix-Mesa-Scottsdale, AZ | Very high above 70% probability of a price decrease | 50-75% |

| 5 | West Palm Beach-Boca Mouse-Delray Beach, FL | Very high above 70% probability of a price decrease | 50-75% |

- Higher interest rates: The Federal Reserve has raised interest rates to combat inflation, causing mortgages to become more expensive. This makes it more difficult for people to pay homes, reducing demand.

- Inventory increase: During the boom, the builders were fighting to keep up with the demand. Now, there are more houses in the market in some cities of Sun Belt, providing buyers more options and potentially reduced prices.

- Affordability concerns: Even with possible price decreases, some Sun Belt markets remain expensive in relation to local income. This can deter potential buyers and soften the market.

A closer look at 5 cities:

Let’s take a close look at each of the five cities identified by Corelogic:

- Provo -Orem, UT: This area saw significant price increases during the pandemic, but things begin to change. According to Realtor.com the price of the median list last month was $ 566,375, a less than 1.4% compared to the previous year. Even so, it has still increased a huge 38% since January 2020. This suggests that the market may be correcting after an unsustainable growth period. High growth leads to high decreases!

- Tucson, AZ: Tucson is another market that experienced a rapid appreciation of prices. The prices of the list in January fell almost 2% compared to the previous year.

- Albuquerque, NM: This city has seen trends similar to Provo and Tucson. Although it is still relatively affordable compared to other Sun Belt markets, the Albuquerque real estate market is showing signs of deceleration. I have also noticed that in the desert regions such as Albuquerque, the lack of rains can make it extremely difficult to do the construction in time and within the budget that leads to inventory problems.

- Phoenix-Mesa-Scottsdale, AZ: Phoenix was one of the most popular real estate markets in the country during the pandemic. However, it now faces significant correction. The increase in inventory and cooling demand are pressing down on prices.

- West Palm Beach-Boca Mouse-Delray Beach, FL: South Florida saw a large influx of people during the pandemic, which increased prices. But the area is also vulnerable to the increase in insurance costs and other factors that could cushion demand. List prices decreased by 10% notable compared to the previous year in Palm Beach County, indicating a significant change in the market.

National Trends versus local realities:

While these five cities are considered at high risk, it is important to remember that the National Housing Market is expected to see modest growth in general. Corelogic projects that national housing prices will increase by 4.1% per year until December 2025. Realtor.com is projecting similar growth of approximately 3.7% Until 2026.

- Why the difference? The real estate market is hyperlocal. What is happening in a city or region could be completely different from what is happening elsewhere.

- Mortgage rates are key: The high mortgage rates remain an important factor that weighs in the market. While the rates remain high, the demand of the buyer will probably remain modified.

- Inventory levels are important: The number of homes for sale will also play an important role. If the inventory continues to increase, prices could trend down.

What does this mean for you?

- Potential buyers: If you are looking to buy in one of these five cities, it could now be a good time to start buying. You may have more negotiation power as prices potentially decrease. Do not try to time the market perfectly. Instead, focus on finding a house that meets your needs and fits your budget.

- Current owners: If you have a house in one of these areas, a price decrease does not necessarily mean that you will lose money. Focus on the long term. If you plan to sell in the near future, it may be worth considering listing your home sooner rather than later. However, the real estate market is very difficult to predict.

- Everyone else: Even if you aren’t directly affected by these trends, it is good to stay informed about the broader real estate market. This knowledge can help you make better financial decisions in the future.

The role of economic experts

Experts like Selma Hepp, Chief economist of Corelogic play a vital role to help us understand the real estate market, since the markets of the Northeast saw the growth of prices due to low inventory, while the southern markets are adjusting to greater inventory and growing costs.

Other economists, such as Thomas Ryan of Capital economy believes that mortgage rates will probably remain close to 7% this year before they potentially decrease in 2026. This suggests that the real estate market will continue to be influenced by the pressures of interest rates in the short term.

The future perspective

This report highlights the risk of price decrease in certain cities, the general perspective for the national real estate market remains relatively positive. Most experts believe that housing prices will continue to grow, although at a slower pace than in recent years.

Here are some key factors to see:

- Mortgage rates: Any significant change in mortgage rates will have a great impact on the market.

- Inflation: How effectively the Federal Reserve will influence interest rates and general economic conditions.

- Housing supply: The new construction level and existing houses for sale will determine how much competition buyers face.

Final thoughts: be informed, prepare yourself

The real estate market is always changing. There are ups and downs. The key is to stay informed, understand trends and make adequate decisions for you.

Whether you are buying, selling or simply observing, I hope this article has given you a better understanding of the factors that influence the prices of homes and the potential risks and opportunities that are coming.