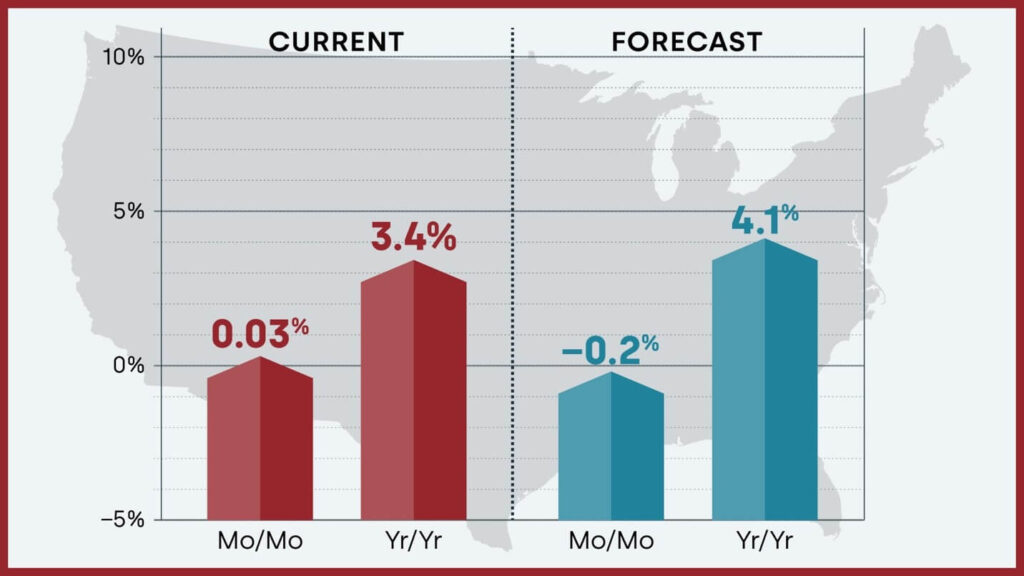

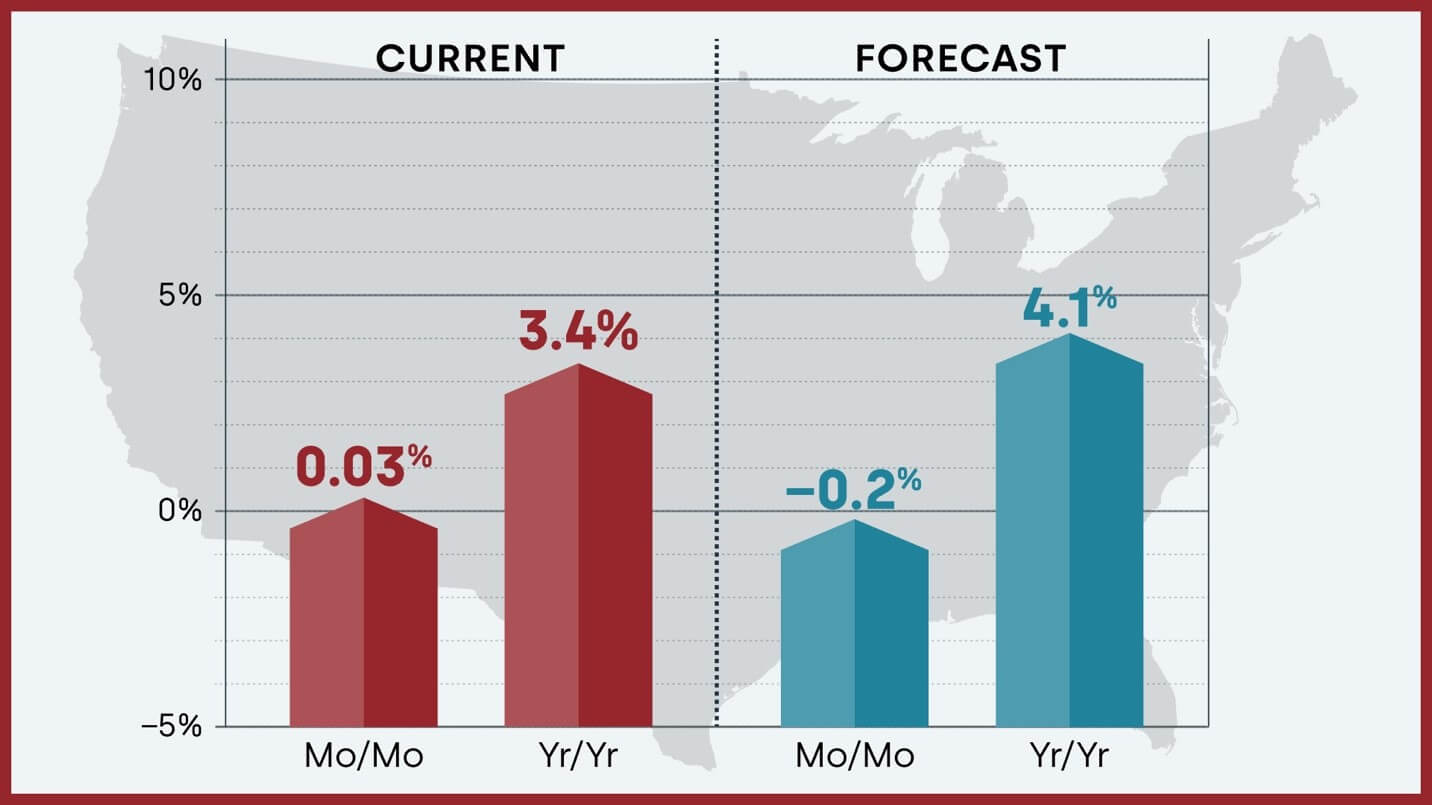

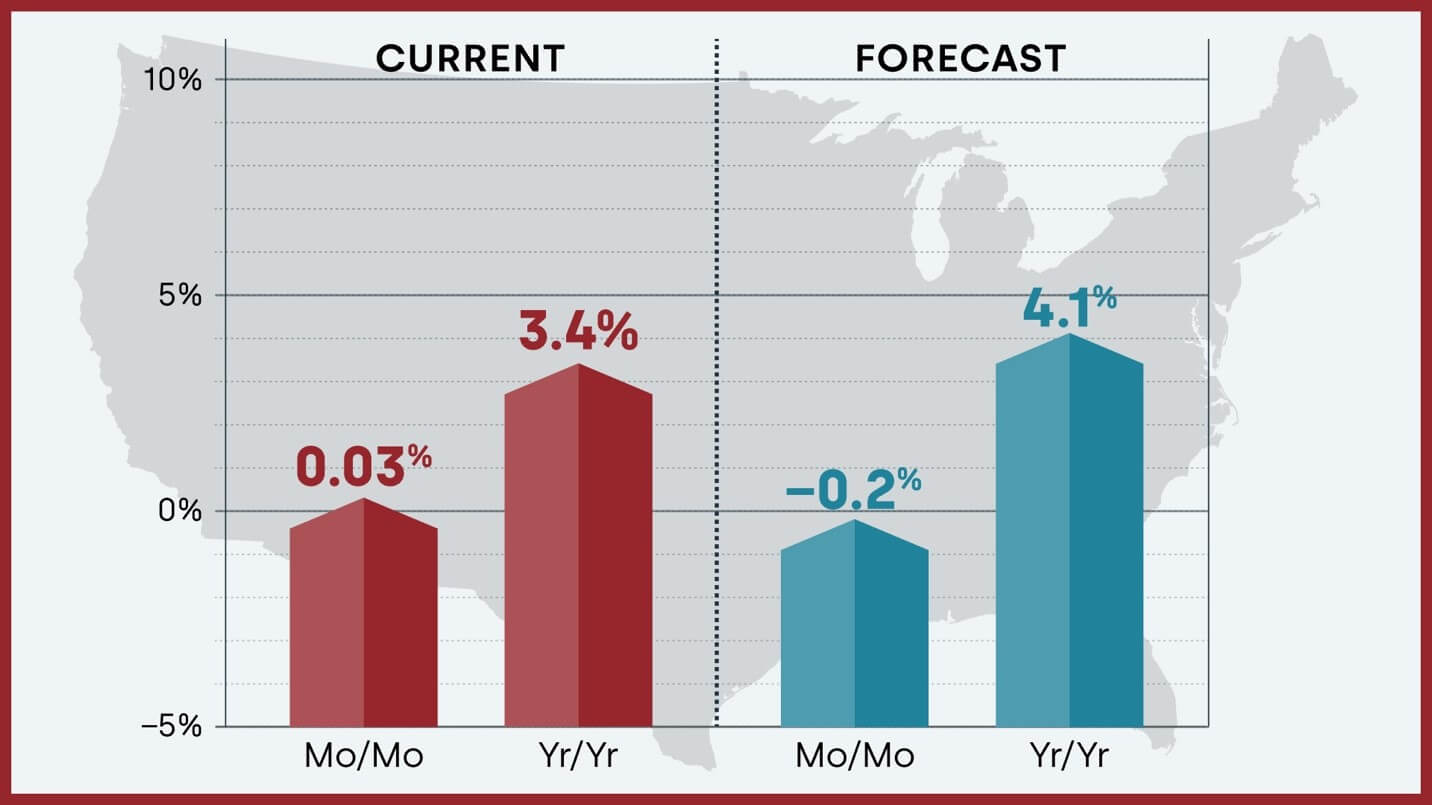

Are you trying to find out what is happening with Housing market prices In early 2025? You are not alone! The real estate market may seem like a roller coaster, and maintaining the latest trends is crucial, whether it is buying, selling or simply monitoring its investment. Here are the good news: Experts predict a 4.1% increase in national housing prices at the end of 2025, compared to December 2024. Let's make a deeper immersion and see what is shaping the market at this time and what we can expect in the coming months.

Housing market forecast: Corelogic sees a 4.1% leap in housing prices in 2025

A look back in 2024: stable but not spectacular

2024 was a year of moderation in the real estate market. We saw a little more inventory than in the previous years, which meant that buyers had some more options. However, the demand remained soft due to factors such as higher mortgage rates. As a result, the price growth was stable, but not as explosive as we saw during the pandemic peak.

According Corelogicalhousing prices throughout the country, including sales in difficultiesIt increased 3.4% year after year in December 2024. While that is a decent gain, it is far from the two -digit appreciation we experienced only a few years ago. About a month, prices barely moved, increasing only 0.03% in December.

2024 key control:

- Moderate growth: The appreciation of the price of housing was slowed compared to previous years.

- Inventory improvement: Buyers had a little more available options.

- Regional differences: Some areas experienced a stronger growth.

What is feeding the forecast by 2025?

So what is behind the projection of an increase of 4.1% in housing prices by the end of 2025? Several factors are at stake:

- The spring shopping season: The real estate market tends to heat up in spring, since families seek to move before the new school year begins. This greater demand could exert upward pressure on prices.

- Limited inventory: While the inventory improved in 2024, it is still below historical averages in many markets. Housing scarcity for sale can generate higher prices.

- Economic factors: The general health of the economy plays a role. If the economy remains stable or improves, it could boost consumer confidence and lead to greater housing purchase activity.

However, it is important to remember that these are only forecasts. Unforeseen events, such as a sudden increase in interest rates or a great economic recession, could certainly change perspective.

Regional variations: Where do prices go?

The real estate market is rarely uniform throughout the country. What is happening in a city or state can be very different from what is happening in another. In December 2024, we saw significant regional variations in the growth of the housing price:

- NORTS STRONG: States like Connecticut (7.8%more) and New Jersey (7.7%) He experienced some of the strongest earnings of the year after year. This is due in large part to the limited inventory in these areas.

- Hawaii and delayed DC: At the other end of the spectrum, Hawaii and the Columbia district saw decreases in the price of housing of -1.1% and -0.7%, respectively.

- Southern markets adjustment: Some southern markets are readjusting the highest inventories and the increase in the costs of variable mortgages.

- Mountain West stabilizing: Mountain West is trying to find stability after experiencing significant price changes in recent years.

Housing price changes year after year by state (December 2024)

| State | Change (%) |

|---|---|

| Connecticut | 7.8 |

| New Jersey | 7.7 |

| Hawaii | -1.1 |

| D.C. | -0.7 |

Main metropolitan areas: winners and losers

Looking at specific subway areas, we also see a mixed results bag.

- Chicago leads the package: In December 2024, Chicago He published the highest gain year after year among the 10 main meters, with 5.6%.

- Other strong artists: Boston, Washington and Miami also saw a solid appreciation of prices.

- Phoenix cooling: In contrast, Phoenix It experienced a more modest growth, which reflects the attempt of the market to stabilize.

Housing price changes year after year by select subway areas (December 2024)

| Metropolitan area | Change (%) |

|---|---|

| Chicago | 5.6 |

| Boston | 4.8 |

| Washington | 4.4 |

| Miami | 4.0 |

| Los Angeles | 4.1 |

| San Diego | 3.2 |

| Phoenix | 2.5 |

| Denver | 1.7 |

| Houston | 3.4 |

| Las Vegas | 5.0 |

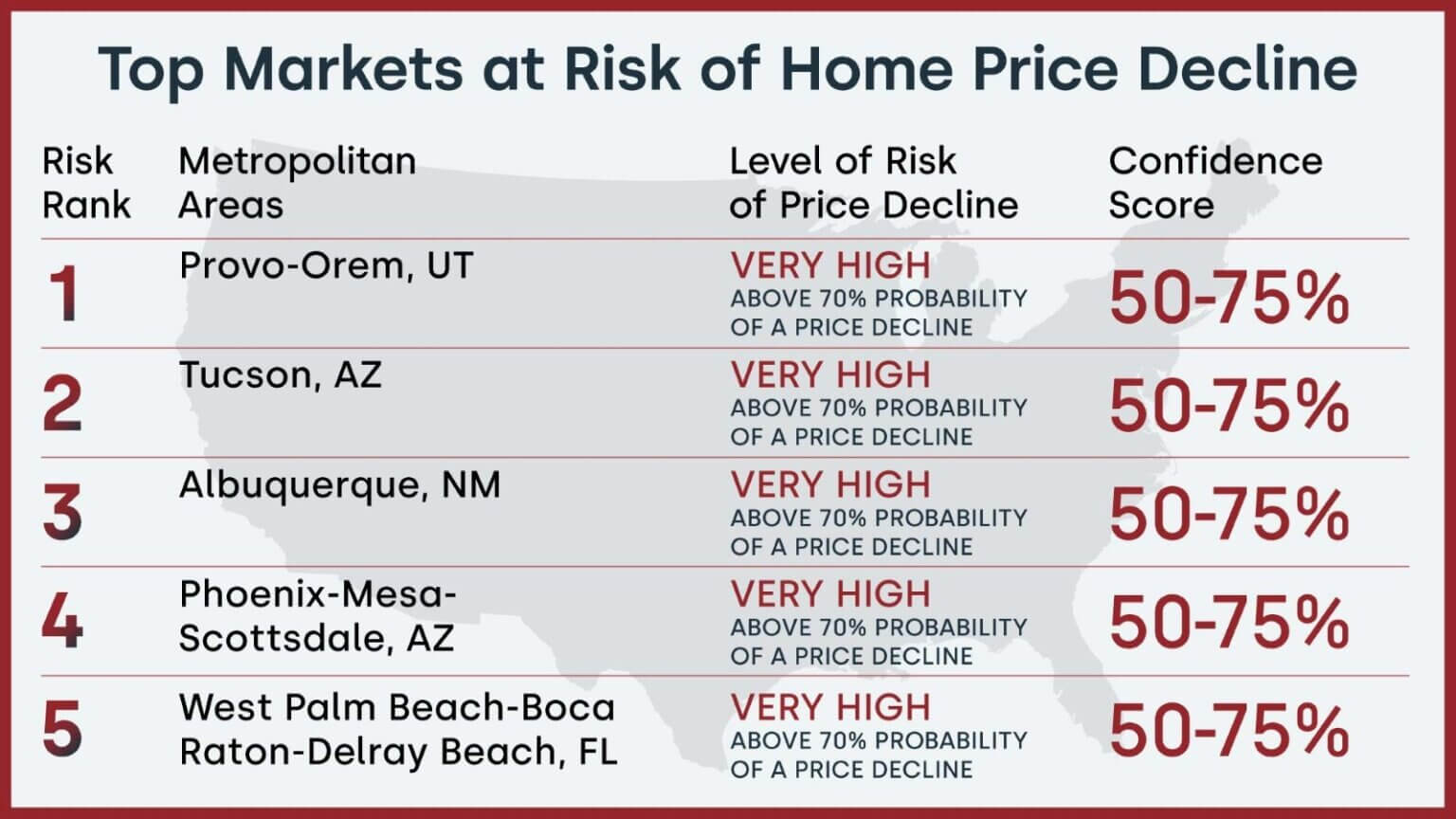

Markets at risk: where prices could fall

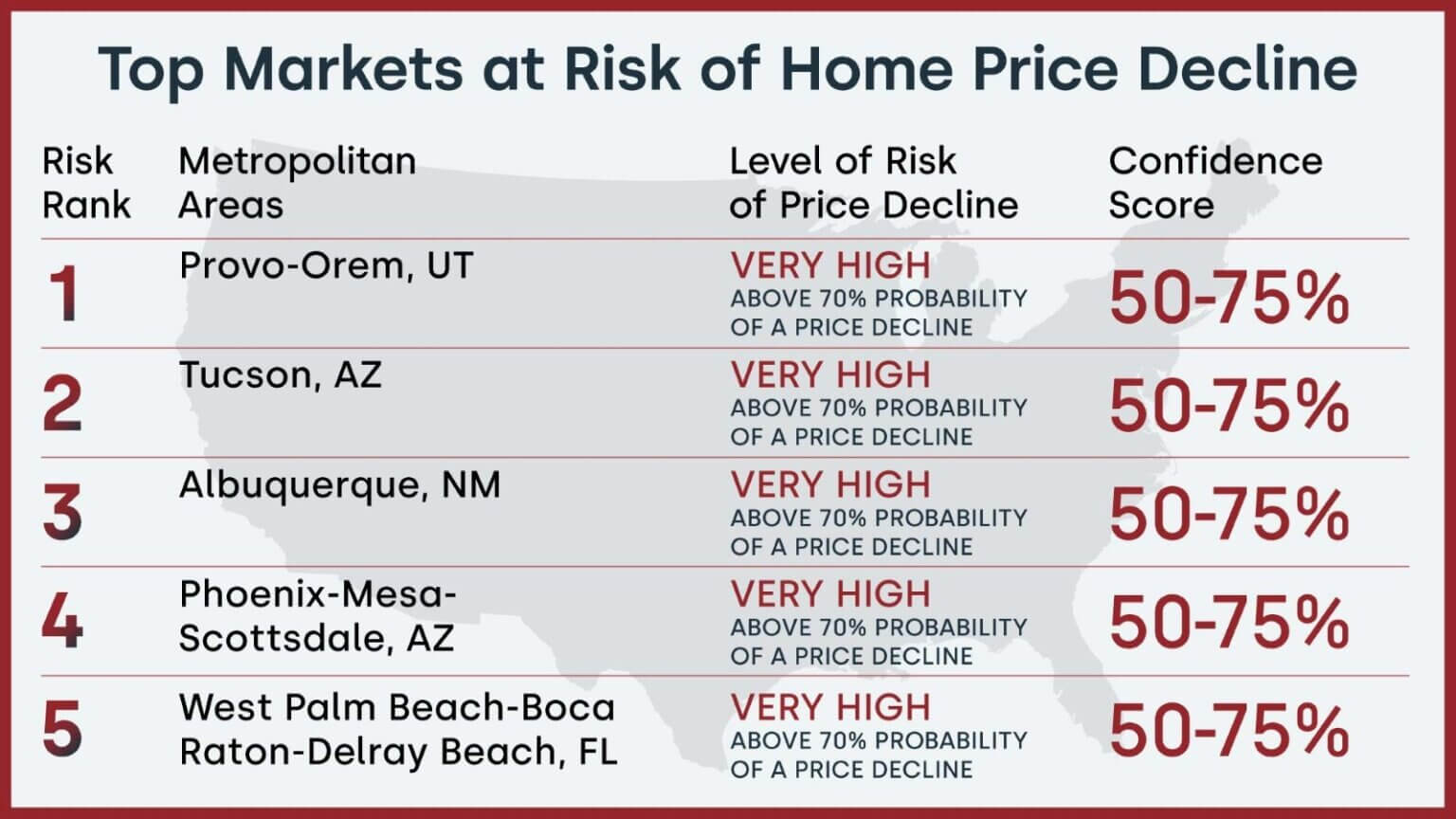

While most areas are expected to see prices in 2025, some markets are considered to have a higher risk of decrease. Corelogic's Market Risk Indicator (MRI) identifies the areas where the real estate market can be overheated or vulnerable to economic shocks.

According to magnetic resonance, the following subway areas are in Very high risk of the price of housing decreases in the next 12 months:

- Provo -orem, ut: This area has a 70%probability of a price decrease.

- Tucson, Az: Also with very high risk.

- Albuquerque, Nm: Another market to see carefully.

- Phoenix-Mesa-Scottsdale, Az: Continuing with its cooling trend.

- West Palm Beach-Boca Mouse-Delray Beach, FL: A surprise entry on this list.

The five main US markets at risk of decreased annual prices (December 2024)

| Range | Metropolitan area | Risk level of price decrease | Trust score |

|---|---|---|---|

| 1 | Provoorem, ut | Very high (70%+) | 50-75% |

| 2 | Tucson, Az | Very high (70%+) | 50-75% |

| 3 | Albuquerque, nm | Very high (70%+) | 50-75% |

| 4 | Phoenix-Mesa-Scottsdale, Az | Very high (70%+) | 50-75% |

| 5 | West Palm Beach-Boca Mouse-Delray Beach, FL | Very high (70%+) | 50-75% |

If you are considering buying or selling in one of these areas, it is especially important to do your research and consult with a local real estate professional.

Factors beyond numbers: forest fires and tariffs

The numbers paint a general picture, but it is crucial to understand the events of the real world that can influence the real estate market. As the main economist of Corelogic, Dr. Selma Hepp, factors such as proposed tariffs and natural disasters can have a significant impact.

- Duty: The possibility of new tariffs on imported construction materials could increase construction costs, which would inevitably be transmitted to housing buyers.

- Forest fires: Events such as devastating forest fires in Los Angeles County in January 2025 can interrupt the supply chain, increase construction material costs and delay construction times.

These types of events highlight the interconnection of the real estate market and the economy in general.

Opinion of experts and my own thoughts

Dr. Selma Hep's analysis offers a valuable context to the data. She emphasizes the current Bifurcation in all marketsWith the northeast experiencing strong growth due to the low inventory, while the southern markets conform to greater inventory and increased mortgage costs. I agree with its evaluation that the real estate market is likely to see a minor increase in prices in 2025 compared to previous years.

In my opinion, although the prognosis of an increase of 4.1% is reasonable, it is crucial to remain cautious. The real estate market is sensitive to changes in interest rates, economic conditions and consumer's feeling. It would be intelligent to closely monitor these factors in the coming months.

What does this mean for you?

Whether he is a buyer, seller or owner, this is what suggests the ideas of the February 2025 real estate market:

- For buyers: Be prepared for a potentially competitive spring purchase season. Get pre -approved for a mortgage, work with a well -informed real estate agent and be ready to act quickly when you find the right property.

- For sellers: If you are considering selling, it could now be a good time to list your home. Prices are expected to continue increasing in most areas, but not overvalue their property.

- For owners: Stay informed about local market conditions and prepare to adjust your plans if necessary. Consider refinancing your mortgage if interest rates fall.

Final thoughts

He Housing market prices They are complex and it is vital to stay informed. While forecasts suggest a moderate price increase in 2025, it is essential to consider regional variations and potential risks. By understanding the factors that influence the market, you can make informed decisions about your real estate investments.

Work with NORADA in 2025, its source of trust to Investment

In the main real estate markets in the United States.

Discover high quality properties and lists for encouragement designed to offer consistent yields.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment directors (without obligation):

(800) 611-3060

(Tagstotranslate) Real Estate Market (T) Real Estate Market 2025 (T) Crassing of the Real Estate Market (T) Real Estate Market Disistent (T) Real Estate Market predictions (T) Real Estate Market Trends (T) Real Estate Market Market of the Real Estate Market