Imagine the hustle and bustle of a busy city where people are always on the move, especially when it comes to buying homes. Goldman Sachs expects home prices to rise more than 4% in 2024 and 2025, a projection that many are watching closely as the housing market continues to show signs of life. With factors such as interest rate changes and the fluctuating job market at play, this forecast raises many questions about what it means for home buyers, homeowners, and those looking to invest in property.

Goldman Sachs expects house prices to rise more than 4% in 2024 and 2025

Key findings:

- Housing prices In the United States, it is expected that they will increase 4.5% in 2024 and 4.4% in 2025.

- Lower interest rates due to Federal Reserve Stocks are driving this rise.

- The housing supply remains restricted, contributing to continued price appreciation.

- Recent Mortgage Rates Fall They have not yet resulted in a significant increase in applications.

- Different United States regions are experiencing varying levels of price growth, with the Midwest and Northeast showing the strongest increases.

US Housing Market Outlook

🏠

Housing prices

It is expected to increase

4.5% in 2024

4.4% in 2025

📉

Interest rates

Lower rates due to

Federal Reserve

behavior

📦

Housing offer

Still limited

Contributing to

price appreciation

📝

Mortgage Applications

There is no significant increase

Despite the recent

rate drop

🗺️

Regional variations

Midwest and Northeast

demonstrating the strongest increases

The housing market has always been influenced by a wide variety of factors, and recent analysis by Goldman Sachs sheds light on what could happen next. Goldman Sachs Analysts have raised the price of their housing appreciation forecasts based on several vital factors due to the economy expected to remain strong and interest rates are projected to decline. But what does this mean for the average person? Let’s dig deeper into this important topic.

Current trends in housing prices

The market has experienced significant fluctuations as a result of economic conditions and global events. At the beginning of the pandemic, many feared a drop in property values. Contrary to expectations, the opposite occurred, as many people opted to purchase their own homes during lockdowns, as demand for housing increased.

This caused an unprecedented rise in prices, which peaked at around 20% Annually. Recently, annual house price growth has stabilized around 5.5% indicating that demand is far from being met, especially with a demographic increase of potential buyers looking for homes in the 30 to 39 year age range, who are starting a family.

Interestingly, the cost of mortgages has experienced a substantial decline, going from a peak above 7.8% in October 2023 to less than 6.5%. Recently, this decline in mortgage rates paves the way for more affordable home buying opportunities, allowing more potential homeowners the opportunity to enter the market despite historical affordability challenges.

Factors driving rising housing prices

A key factor driving the rise in home prices as forecast by Goldman Sachs is the expected interest rate cuts by the Federal Reserve. As the labor market shows signs of easing, economists predict that the Federal Reserve will implement multiple rate cuts in the near future. Lower rates mean lower borrowing costs, which in turn make homes more affordable for buyers even as prices continue to rise.

Interestingly, the phrase “bad news is probably good news” reflects current market sentiment. Analysts suggest that concerns about economic downturns may lead to interest rate cuts that ultimately benefit home buyers. While concerns about employment continue to circulate, home prices appear to be resilient, with low permanent layoff rates supporting a stable labor market.

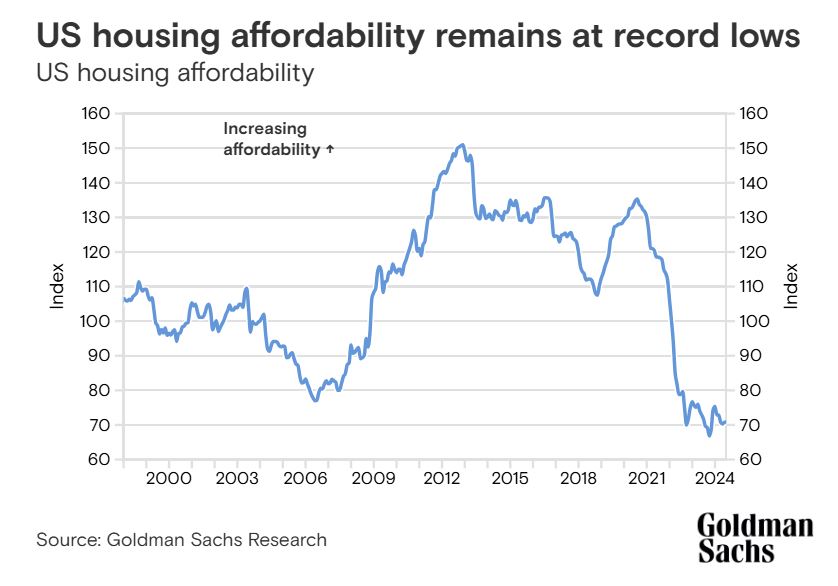

The affordability conundrum

While housing prices are rising, the question of affordability It remains a hot topic. Current affordability levels are said to be the worst since the early 1980s. Anxiety over rising prices has led many to wonder whether potential buyers will be priced out of the market entirely.

In the past, affordability issues were often resolved by sudden drops in home prices. However, Goldman Sachs believes the current scenario may lead to a more gradual return to normalized levels of affordability. With mortgage rates expected to decline further and real disposable incomes projected to grow modestly, there may still be hope for buyers looking to enter the market.

Regional variations in housing prices

The projected growth in home values is not uniform across the United States. According to Goldman Sachs, some regions are experiencing much healthier appreciation rates than others, such as the Midwest. Often recognized as the most affordable area in the country, it is experiencing notable price increases, particularly in cities such as Cleveland and Chicago.

The Northeast with centers such as New York and Boston has also shown strong growth in housing prices. On the contrary, in California, markets such as San Diego are thriving, despite historical concerns about affordability challenges. Meanwhile, in the Southeast especially Florida, has shown a decline in affordability that challenges its former status as a budget destination.

The future of housing prices and the economy

Looking ahead, Goldman Sachs has expressed optimism about the housing market, expecting it to remain buoyant with 4.5% growth in 2024 and 4.4% in 2025. There are a couple of factors contributing to this positive outlook.

First of all, expected interest rate cuts and lower borrowing costs seem likely to spur buyer activity when it comes to mortgages. Analysts predict that lower borrowing costs will help buyers who have been on the fence for some time.

Secondly, while affordability issues persist, income growth rates are expected to remain positive, providing more purchasing power to buyers. The challenge is to see whether these factors will create a balance, stabilizing the market without causing a drastic fall in housing prices.

Consumer sentiment and market expectations

Despite notable changes in mortgage rates, the market has yet to see a surge in mortgage applications. This stagnation could be due to a combination of seasonal predictability and buyer reluctance to enter a fluctuating market. As families begin to settle into a routine with school-aged children, it is common for many to decide not to move during this transitional period.

In addition, Goldman Sachs’ long-term projection suggests a gradual recovery towards a more favorable scenario of a level of affordability by the end of the decade, which will require patience from both potential buyers and real estate investors.

In this changing landscape, it remains vital for market observers and potential buyers to stay in touch with regional trends, bearing in mind that there are differences even within a country that appears unified under certain economic pressures.

As the housing market continues to evolve, it will be fascinating to see how these predictions play out. Factors such as Federal Reserve policies, employment rates, and household dynamics will undoubtedly shape the experiences of homebuyers and homeowners in the years ahead.