Are you thinking about buying a house? You’re not alone. Owning a home is a dream for many, but today’s market can be confusing. With rising interest rates and high home prices, it’s no surprise that many people are wondering if they should buy now or wait.

Well, like most things in life, the answer is not a simple yes or no. It depends on your individual circumstances and specific market trends in your desired area. Let’s dive into some recent data to help you make this decision.

Is now the right time to buy a house?

There is no general answer to whether it is a good time to buy a home in 2024. The market is complicated right now, and there are both pros and cons to consider:

Challenges:

- High prices: Both mortgage rates and home prices are rising, making affordability a major concern for many buyers.

- Low confidence: Consumer confidence in the housing market is low and many people expect prices or rates to drop.

Potential benefits of buying now:

- Blocking: If you find a home you love and can afford the monthly payment, locking in a mortgage rate now could provide stability in your housing costs compared to rising rents.

- Building equity: Owning a home allows you to build equity over time, while rental payments do not contribute to ownership.

Possible benefits of waiting:

- Lower costs: Mortgage rates or home prices could decrease in the future, leading to a better financial deal.

The best course of action depends on your individual situation.

To do Consumer Do the surveys show?

Consumer confidence is affected

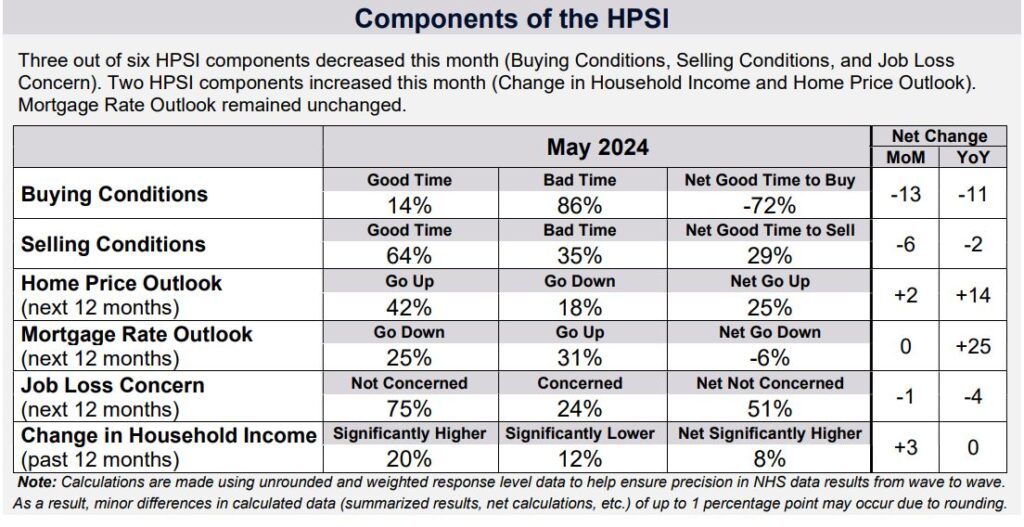

A recent survey by Fannie Mae shows a clear picture: consumer confidence in the housing market is low. In fact, according to the survey, it is at an all-time low. Only 14% of respondents believe it is a good time to buy, while a whopping 86% say it is a bad time. This change reflects a growing concern about affordability. Many potential buyers worry that rising mortgage rates and high home prices are simply out of reach.

Why wait? Rates and prices on the rise

There is some logic behind this concern. Many consumers expect both mortgage rates and home prices to continue rising for the foreseeable future. This means that waiting could put you in a better financial position in the future. Potentially lower interest rates could translate into a more affordable monthly payment. Plus, if the housing market weakens and prices drop slightly, you could get a better deal.

But waiting is not always wise

Of course, waiting is not a guaranteed path to success. The real estate market is complex and there is no way to predict future trends with absolute certainty. While rates could go down, they could also continue to rise. Similarly, home prices could stay high or even rise higher due to low inventory.

Here’s another factor to consider: waiting means you’ll keep renting. Rental prices have also increased, and locking in a mortgage payment could provide some stability in monthly housing costs. Additionally, there is the benefit of building capital over time. Every payment you make on your mortgage goes toward owning your home, while rent payments simply put money in the homeowner’s pocket.

So should you buy a home now or wait until 2025?

The question of buying a house is eternal, but in May 2024 it seems especially complicated. The real estate market has been on a roller coaster ride in recent years, and with conflicting predictions swirling, it’s natural to wonder: should you take the plunge now or wait for a potentially calmer time? 2025?

Below is a breakdown of the key factors to consider when making this crucial decision:

The current panorama

- Interest rates: One bright spot for potential buyers is the recent drop in interest rates from their late-2023 highs. This translates into greater purchasing power, allowing you to stretch your budget even further. However, experts predict that rates may fluctuate throughout the year.

- Housing prices: While the rapid price increases of recent years could be slowing, some forecasts suggest continued but slower growth in 2025. This means the home you want could be more expensive next year.

- Inventory: Inventory remains relatively low, which can lead to bidding wars and a competitive environment. However, some reports indicate a slight increase in listings, which could offer more options in the coming months.

Buying in 2024: pros and cons

Advantages:

- Lower interest rates: As mentioned above, getting a mortgage with a favorable rate can significantly impact your monthly payments and overall affordability.

- Set a price: While future trends are uncertain, waiting could mean a higher price for the home you love.

- Building equity: The sooner you become a homeowner, the sooner you will start building equity, a valuable long-term asset.

Cons:

- Market volatility: The real estate market can be unpredictable. Interest rates could rise again and economic factors could influence prices.

- Competence: Low inventory can make it difficult to find your dream home and win bids in a competitive market.

- Are you ready?: Buying a home is a major commitment. Make sure your finances are in order and you are prepared for the responsibilities of homeownership.

Waiting until 2025: pros and cons

Advantages:

- Potentially lower prices: Some experts predict a slight drop in home prices in 2025, which could be beneficial for buyers.

- Market stabilization: A less volatile market could lead to a more balanced buying experience with fewer bidding wars.

- More inventory: An increase in listings could give you a wider selection of homes to choose from.

Cons:

- Higher interest rates: There is no guarantee that interest rates won’t rise again in 2025, which could negate any price gains.

- Opportunity cost: The longer you wait, the longer you will miss out on the benefits of homeownership, such as building equity and potential property value appreciation.

The conclusion: it’s personal

The decision to buy a home ultimately depends on your individual circumstances.

- Financial preparation: Do you have a stable income, a healthy down payment, and an emergency fund? Can you comfortably afford the monthly mortgage payment, property taxes and insurance?

- Long term plans: Do you plan to stay in the house for several years? Otherwise, the transaction costs associated with buying and selling could outweigh the benefits.

- Lifestyle Considerations: Are you prepared for the responsibilities of homeownership, including maintenance and repairs?

Seek expert advice

Consulting a qualified real estate agent and mortgage lender is essential. They can provide you with personalized guidance based on your financial situation, desired location, and market trends in your specific area.

Remember, there is no perfect time to buy a home. By carefully weighing the pros and cons, considering your personal needs, and seeking professional advice, you can make an informed decision that puts you on the path to achieving your dream of home ownership.