Mortgage rates in the United States continue to show some fluctuations, with a slight upward trend seen last week. Here is an analysis of the current averages and expert predictions for the next two years. As of June 16, the national average 30-year fixed mortgage rate is 7.00%, a drop of 3 basis points since the same time last week. Mortgage rates fell this week.

These figures represent a snapshot of the current state of the mortgage market, which is influenced by a host of economic factors, including inflation, Federal Reserve policies and the global financial climate. The Federal Reserve's recent forecast suggests possible rate cuts in 2024, which could provide some relief to home buyers in the coming months.

- Fixed 30 years: The average rate for this popular option is approximately 7%.

- 15-year fixed: Offering a faster payment strategy, the 15-year fixed rate averages 6.45%.

- 5/1 Adjustable Rate Mortgage (ARM): If you have a shorter home purchase timeframe (5 to 7 years), adjustable rate mortgages with a lower introductory rate might be an option. The current average for these mortgages is around 6.61%.

Expert predictions on mortgage rates for the next two years (2024-2026):

Most experts expect rates to remain elevated for the foreseeable future, with the possibility of some decline.

- Freddie Mac: Your forecast sees that rates remain above 6.5% at least until the second quarter of 2024.

- Fannie Mae: His revised perspective anticipates a Fixed rate for 30 years reaching 6.4% at the end of the year, slightly higher than its previous estimates.

- National Association of Realtors: Chief economist Lawrence Yun suggests rates will likely range between 6% and 7% for most of 2024He cites factors such as inflation and budget deficits as contributing influences.

Looking ahead, mortgage rate predictions for the next two years suggest a gradual decline. Experts from various financial institutions and housing associations have weighed in and reached a consensus that while rates may not experience a drastic drop, there is an expectation that there will be a downward trend.

He Mortgage Bankers Association (MBA) predicts that the 30-year fixed rate mortgage will finish 2024 in 6.1% and reach 5.5% at the end of 2025This aligns with the sentiment of other industry analysts, who anticipate that potential Federal Reserve rate cuts could ease mortgage rates slightly.

He National Association of Realtors echoes this perspective, project that mortgage rates will have an average of around 6.8% in the first quarter of 2024with a gradual decrease until 6.1% At the end of the year. Similarly, From Fannie Mae The mortgage rate forecast suggests that the 30-year mortgage rate will end in 2024 in 6.4%compared to a previous forecast of 5.9%. These projections are subject to change as they depend on various economic indicators and policy decisions that could alter the course of the mortgage rate trajectory.

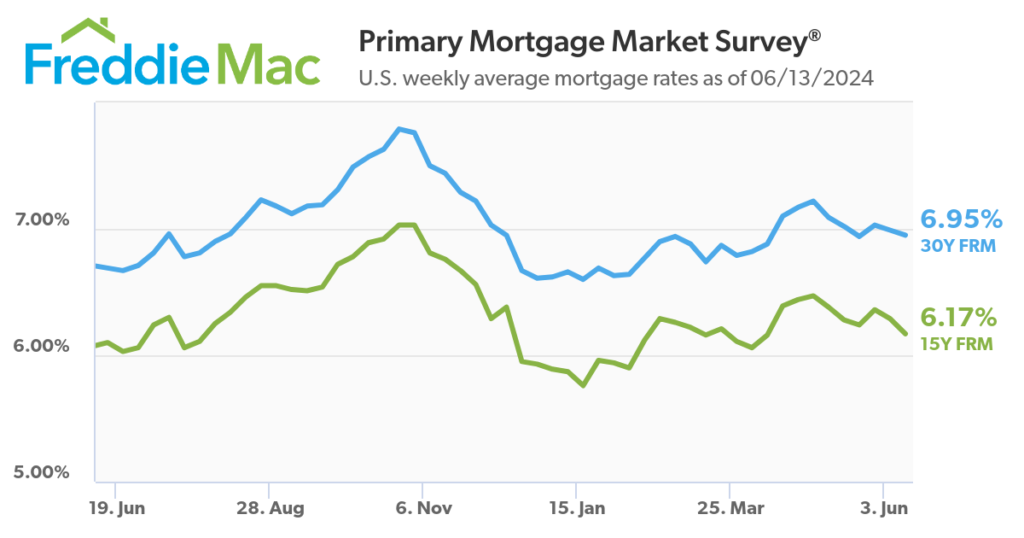

This chart shows the trend of the 30-year and 15-year FRM averages from June 2023 to June 2024. The 30-year fixed-rate mortgage increased by 0.26%, while the 15-year FRM increased by 0.07%.

Factors influencing mortgage rates over the next 2 years

As we look ahead to the next two years, several key factors could influence the direction of mortgage rates in the United States.

- Federal Reserve Policies: The Federal Reserve's monetary policy is a key determinant of mortgage rates. Interest rate decisions, influenced by economic data and inflation targets, directly affect the cost of borrowing. The Fed noted interest rate cuts could lead to a decrease in mortgage rates, fostering a more favorable borrowing environment.

- Inflation: Inflation remains one of the most important factors affecting mortgage ratesEfforts to curb inflation could result in interest rate adjustments, and higher inflation would generally lead to higher mortgage rates to counter an overheating economy.

- Economic growth: The overall health of the economy plays a crucial role. Strong economic indicators could push rates higher as demand for credit increases, while signs of a slowdown could lead to cuts in an effort to stimulate borrowing and investment.

- Real estate market dynamics: The balance between supply and demand in the real estate market will also affect rates. A surplus of homes could lead to lower rates to encourage buying, while a shortage could drive up rates as competition for available homes increases.

- Global events: International events, such as geopolitical conflicts or global economic crises, can affect investor confidence and cause fluctuations in mortgage rates as investors seek safer assets, such as U.S. Treasury bonds, influencing yields and borrowing costs.

- Government policies: Fiscal policies, including tax laws and housing regulations, can influence mortgage rates. For example, policies that encourage housing construction can increase supply, which could lead to lower mortgage rates.

- Consumer behavior: Mortgage demand is also determined by consumer confidence and demographic trends. Changes in homebuyer preferences or shifts in population growth can affect mortgage demand and, consequently, rates.

- Bond market movements: Mortgage rates are closely tied to the bond market, particularly the 10-year Treasury yield. As investor perceptions of risk change, so do bond yields, which can lead to corresponding changes in mortgage rates.

- Health of the banking sector: Banks' financial stability and lending practices can influence mortgage rates. A strong banking sector can offer more competitive rates, while a struggling one can restrict lending and raise rates.

- Technological advances: The rise of fintech and online lending platforms has introduced more competition to the mortgage industry, which could lead to more favorable rates for consumers as companies compete for business.

Summary: Experts from various financial institutions and housing associations have weighed in and reached a consensus that while rates may not see a dramatic drop, a downward trend is expected over the next two years. While forecasts can provide general direction, actual rates will depend on how these factors evolve.

RELATED POSTS:

Mortgage Rate Predictions for 2024: Will Rates Fall?

Mortgage rate predictions for the next three years: double-digit increase

Mortgage rate predictions for the next 5 years

Mortgage rate predictions for the next 2 months

Will mortgage rates fall below 7% in 2024? Latest predictions

Mortgage Rates Hit a New Low: Predictions and What It Means for You