we publish Q4 2022 Portfolio Performance on January 31, 2023.

We will publish Q1 2023 portfolio performance on April 28, 2023; This will include annual revaluations of all properties, carried out by RICS accredited independent surveyors.

Today's update covers important activities in February:

- Better's investment in the Exchange and LHX fully shared investment plan

- Capital Fund Raisings and Shareholder Votes

- Enhanced property-by-property disclosure

- Unit Disposals

1. Better's investment in the Exchange and LHX fully shared investment plan

February was Better's first month of direct investment in the Stock Market, which was completed in accordance with the Investment policy.

This investment is creating greater liquidity and more efficient pricing across the market. The volume traded on the Stock Market in February is the highest in the last 8 months.

For investors looking to sell, this improved liquidity offers a greater opportunity to exit.

In addition to Better's investment, funds invested in the LHX Fully Shared Investment Plan have been successfully deployed. Customers who invested in February LHX All-Share are diversified across 39 properties and achieved an average discount of 25% on the vacant possession value (after all charges and taxes). This represents an unrealized capital gain of 34% on the investment cost.

Client funds are invested monthly and our March deployment It is open for financing until 11:59 p.m. today, February 28.

2. Capital fundraising and shareholder votes

In February, we identified 4 properties that need new capital to strengthen their financial position:

For all four properties, shareholders voted to achieve this through equity fundraising rather than auction sales.

All four equity fundraisings successfully passed the 50% threshold, 2 of which exceeded 100%, raising a total of over £570,000. These 4 properties now have significantly stronger balance sheets to make orderly disposals of units to maximize sales prices.

Three more properties will hold shareholder votes in March, which will be announced tomorrow.

3. Enhanced property-by-property disclosure

Information is the lifeblood of our Exchange and we are proud of the market-leading disclosures we produce for each property. We constantly improve the information provided, including valuable investor feedback.

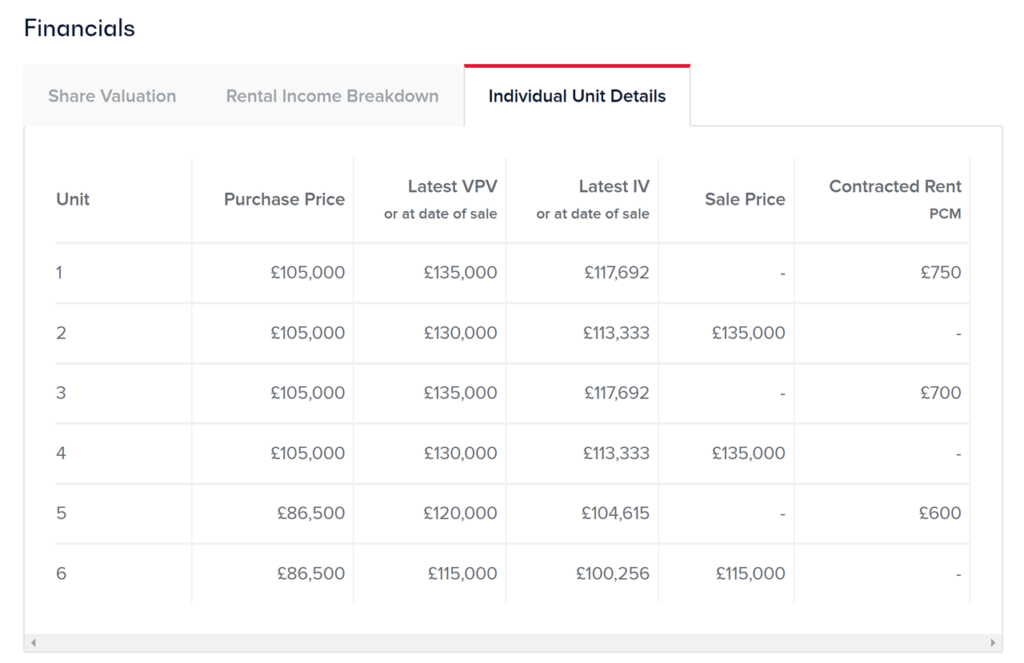

All residential properties now shows Individual Unit Details in a new tab in the “Finances” section.

For each unit, this shows the purchase price, the latest independent valuations and, where applicable, the sales price and contracted rent. Here is an example, Lydan House:

In March, we will develop this further to include the 'status' of each unit, to show when properties become vacant for sale, on offer etc.

All mortgaged properties will show from tomorrow the Mortgage Due Date in the “Property Details” section.

As has been reported in detail over the past year, mortgage interest rates have increased significantly and are now published for each mortgage. Mortgage maturity dates will now be added given their importance with respect to pressure on the disposal of units for repayment, fees on bank refinancing/extension arrangements and full refinancing risk.

4. Disposals of units

Unit sales continue apace across the portfolio. The details of each removal are updated every month on our Sales record.

In January and February, we completed 12 sales, achieving a combined sales value of £1,980,000:

- 6.5% above the independent vacant possession value of £1,858,000

- 23% above the original purchase price of £1,607,000

If you have questions about this update, please email us at [email protected]

Best wishes,

The LHX team

Capital at risk. The value of your investment may go up or down. The Financial Services Compensation Scheme (FSCS) protects the cash held in your London House Exchange account; However, investments you make through the London House Exchange are not protected by the FSCS. In the unlikely event that London House Exchange runs into difficulties, PricewaterhouseCoopers LLP has been pre-engaged to manage the sale of the property portfolio; read more about our Investment Guarantees here. Performance information (including any expression of opinion or forecast) reflects the most current data at the time of production; The publication is made in good faith on the basis of publicly available information or sources believed to be reliable. Past performance and/or forecasts (if provided) are not a reliable indicator of future performance. Interest and principal returned may be less than expected. Gross rent, dividends and capital growth may be lower than estimated. The exit of your investments (on the stock market, through the fifth anniversary process or according to specific strategies) is subject to price and demand. London House Exchange does not provide tax or investment advice and clients are advised to obtain appropriate tax or investment advice where necessary. London House Exchange Limited Financial Promotion (No. 8820870); authorized and regulated by the Financial Conduct Authority (No. 613499). See Key risks for more information.